Condensed Interim Financial Statements for the Financial Period of Nine Months Ended 30 September 2025

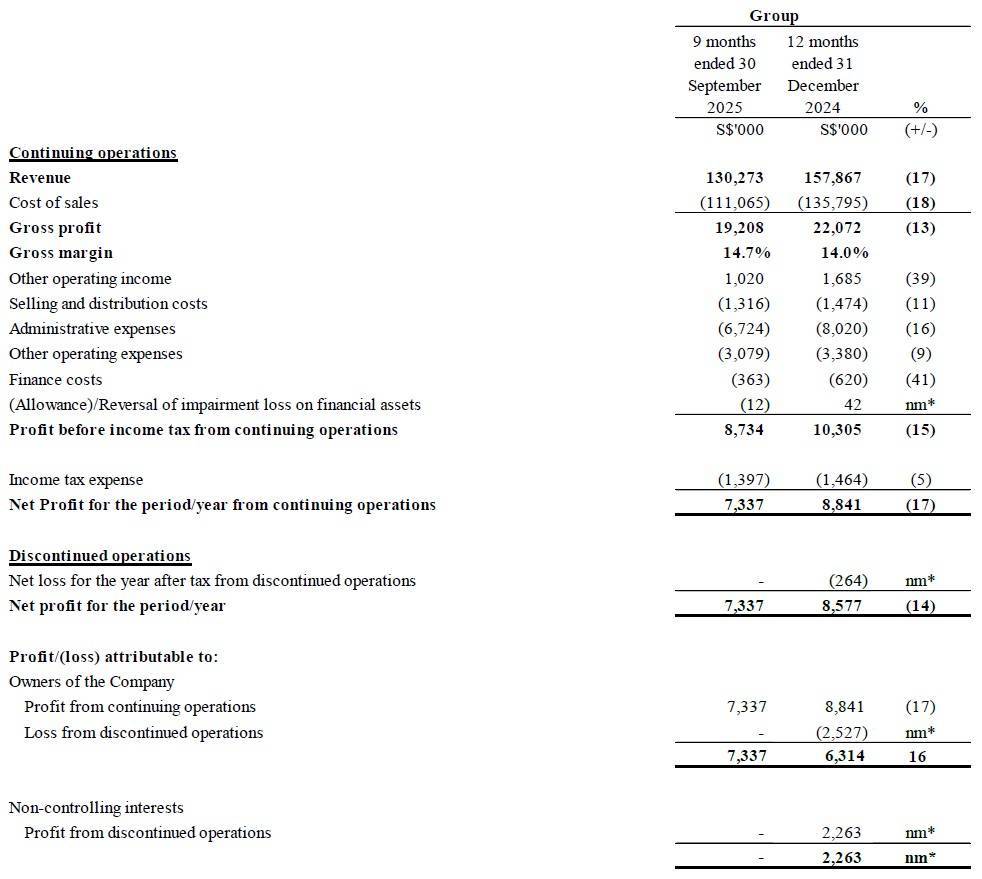

Financials ArchiveCondensed interim consolidated statement of profit or loss and other comprehensive income

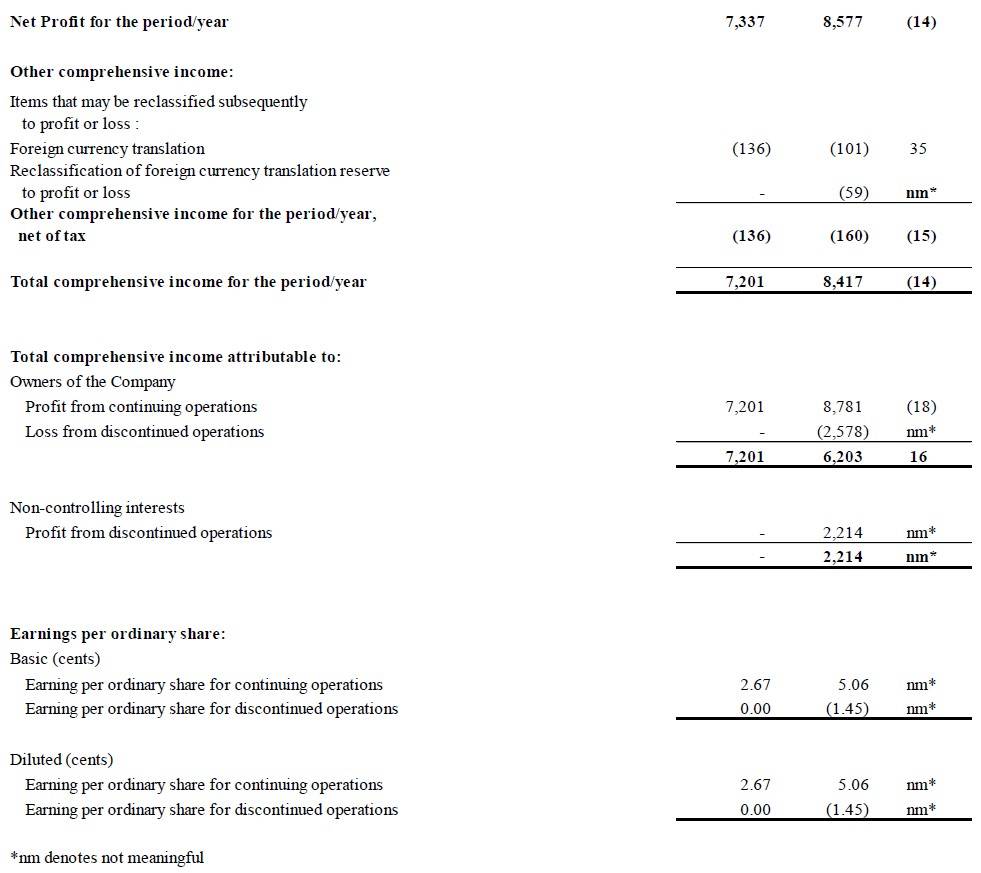

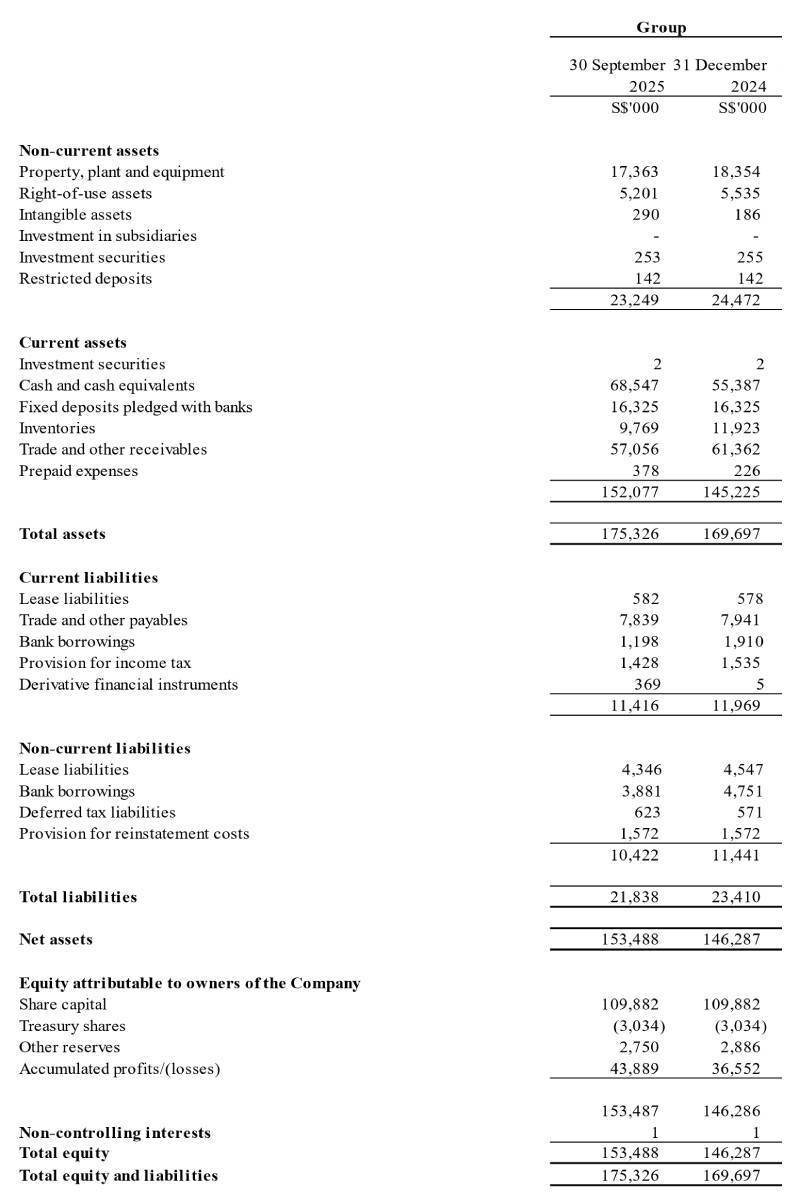

Condensed interim statements of financial position

Review of Performance

-

Review of Performance

Results for FP2025 versus FY2024

Continuing operations

Revenue and Gross Profit

The Group achieved revenue of S$130.3 million in FP2025, compared to S$157.9 million in FY2024. The lower revenue in FP2025 was primarily due to the shorter reporting period of 9 months, following the change of financial year end from 31 December to 30 September as well as the continued decline in steel prices which impacted the average selling price.

Despite the lower revenue, gross profit margin improved slightly to14.7% in FP2025 compared to 14.0% in FY2024. This was mainly attributable to a reduction in cost of sales, driven by lower average cost of material costs during the financial period.

Other Operating Income

Other operating income declined to S$1.0 million in FP2025, from S$1.7 million in FY2024. This was mainly attributed to the absence of fair value gains from forward currency contracts and foreign currency exchange gains.

Selling and Distribution, Administrative, Other Operating and Finance Expenses

Total selling and distribution costs incurred fell to S$1.3 million in FP2025 compared to S$1.5 million in FY2024, in line with less delivery volumes in FP2025.

Administrative expenses decreased to S$6.7 million in FP2025 compared to S$8.0 million in FY2024 mainly due to decrease in staff cost that comes with the nine-month operations in FP2025 compared to twelve-month operations in FY2024.

Other operating expenses for FP2025 decreased to S$3.1 million, from S$3.4 million in the previous financial year. The decline was mainly due to a loss of S$0.5 million in fair value of forward currency contracts and foreign exchange difference, offset by lower operation costs incurred during the shorter reporting period in FP2025 compared to FY2024.

Total finance costs incurred amounted to S$0.4 million in FP2025, compared to S$0.6 million in FY2024, mainly due to decrease in bank borrowings from FY2024 to FP2025 amounting to S$1.6 million.

Profitability

The Group reported a net profit before tax from continuing operations of S$8.7 million in FP2025 in comparison to net profit before tax of S$10.3 million in FY2024. Although the reported figure was lower in absolute terms, the nine-month FP2025 result represented stronger underlying profitability on an annualised basis.

The Group's income tax expense for FP2025 was S$1.4 million compared to S$1.5 million in FY2024.

As a result, the Group recorded a net profit after tax from continuing operations of S$7.3 million in FP2025, compared to a net profit after tax of S$8.8 million in FY2024.

Discontinued operations

The Group incurred a net loss after tax of S$264,000 in FY2024 for its discontinued operation. The discontinued operation was divested on 13 February 2024.

-

Balance Sheet

The Group's non-current assets, comprising mainly property, plant and equipment and right-of-use assets amounted to S$23.2 million as of 30 September 2025 compared to S$24.5 million as at 31 December 2024. There were no significant additions during the financial period.

As of 30 September 2025, the Group's inventory on hand reduced to S$9.8 million from S$11.9 million as at 31 December 2024, reflecting the Group's ongoing efforts to optimise inventory levels.

Trade and other receivables amounted to S$57.1 million as of 30 September 2025, compared to S$61.4 million as at 31 December 2024 mainly due to improved collections.

There was no significant change in trade and other payables, which stood at S$7.8 million as of 30 September 2025 and S$7.9 million as of 31 December 2024.

Total bank borrowings decreased to S$5.1 million as of 30 September 2025 from S$6.7 million as of 31 December 2024 mainly due to loan repayments.

-

Statement of Cash Flows

The Group generated cash flows from operating activities of S$15.7 million in FP2025. This was due to profits from operations and net increase in working capital, primarily due to a decrease in trade and other receivables and inventories.

Net cash used in investing activities for FP2025 amounted to S$0.5 million. This included S$0.4 million for the purchase of property, plant and equipment and S$0.1 million for the purchase of intangible assets.

Net cash used in financing activities for FP2025 totaled S$2.1 million. This amount included S$1.6 million in banks borrowings repayment and S$0.5 million in principal lease repayments.

As at 30 September 2025, the Group's cash and cash equivalents rose to S$68.5 million as compared to S$55.4 million as at 31 December 2024.

-

Commentary

According to the IMF's October 2025 World Economic Outlook, global growth is projected to slow from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026. This reflects continued resilience despite emerging challenges, including trade policy uncertainties and less severe-than-expected tariff disruptions. However, medium-term risks remain tilted towards the downside, driven by inflationary pressures, geopolitical tensions, rising protectionism, and policy uncertainty.

Singapore's economy grew 2.9% year-on-year in Q3 2025, down from 4.5% in Q2. Manufacturing stagnated, while construction grew 3.1%, moderating from 6.2%. Despite the slowdown, growth exceeded expectations due to front-loaded trade activity and strong consumer demand. Overall, GDP rose by 3.9% year-on-year in Q1-Q3. Looking ahead, growth may ease as trade normalises, but global AI investments, infrastructure projects, and supportive financial conditions should continue to bolster key sectors.

Singapore's construction sector is expected to grow steadily, supported by the Urban Redevelopment Authority's (URA) Draft Master Plan 2025 — a long-term framework that guides land use planning over the next 10-15 years. The plan prioritizes sustainable growth, enhanced transport connectivity, and the creation of vibrant mixed-use districts. Key initiatives include the redevelopment of the Greater Southern Waterfront, the growth of Jurong Lake District as a key economic hub, and the expansion of MRT lines to strengthen island-wide accessibility.

Aligned with these strategic priorities, the Building and Construction Authority (BCA) projects annual construction demand to range between S$39 billion and S$46 billion from 2026 to 2029. This demand will be driven by public housing, MRT extensions, and major infrastructure developments such as Changi Airport Terminal 5, the Integrated Waste Management Facility, and Tengah General Hospital. Sustained public-sector investment, a robust housing pipeline, and renewed private development activity will reinforce sector momentum. However, global uncertainties and potential delays in large-scale projects may affect timelines and overall performance.

As a key player in Singapore's construction steel supply chain, the Group is strategically positioned to benefit from the country's accelerating infrastructure development and large-scale project rollouts. This advantage supported a sales volume increase of approximately 29% in FP2025, compared to the same nine-month period in the previous financial year. However, subdued property market conditions in China have significantly dampened domestic steel demand, resulting in a global oversupply of steel rebar and downward pressure on prices. These dynamics have impacted profit margins and reduced contract competitiveness. To address these challenges, the Group will implement agile procurement strategies, deepen client engagement, and secure long-term contracts to build a resilient order book and maintain financial stability.