Condensed Interim Financial Statements for the Six Months and Full Year Ended 31 December 2024

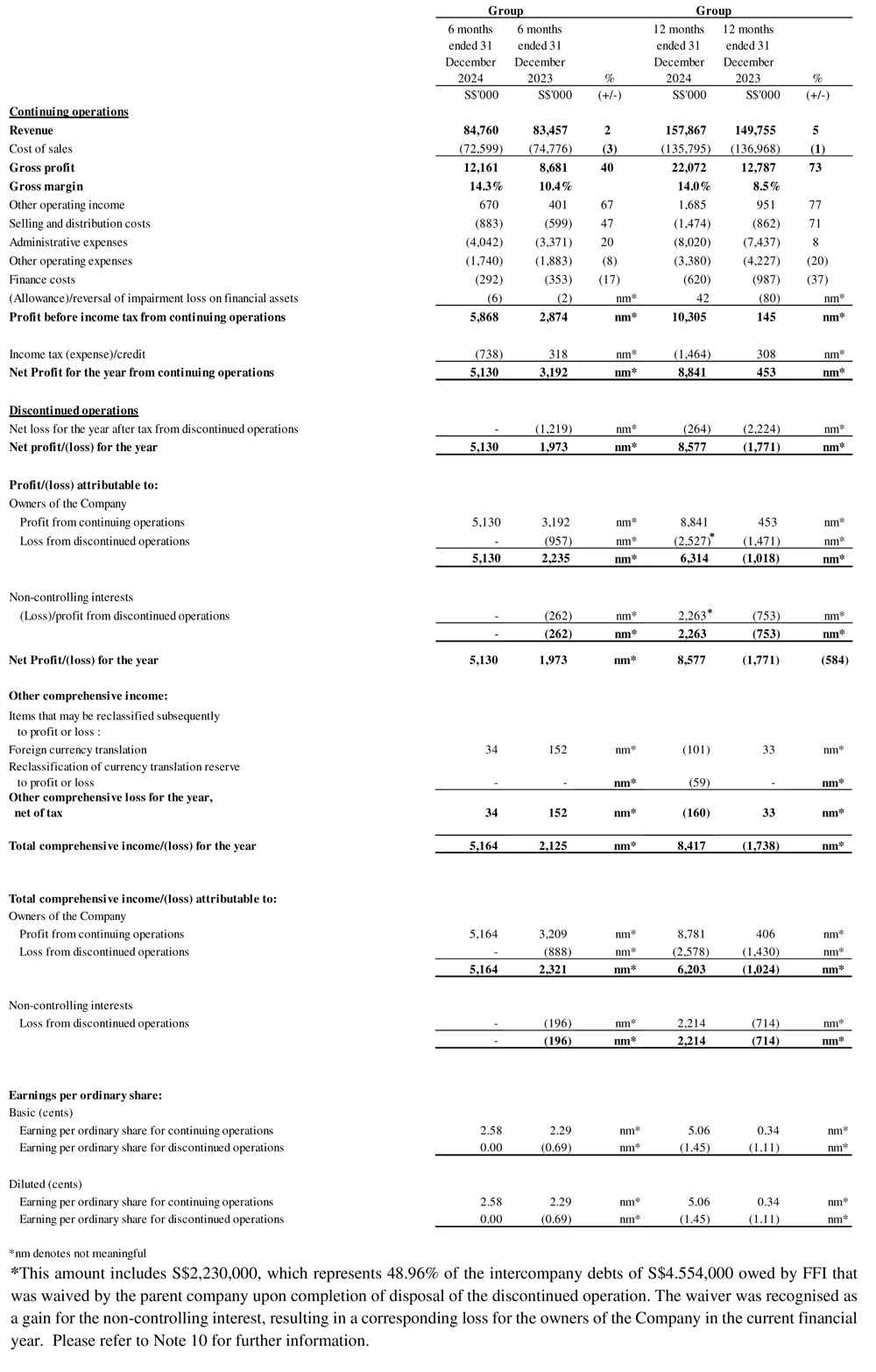

Financials ArchiveCondensed interim consolidated statement of profit or loss and other comprehensive income

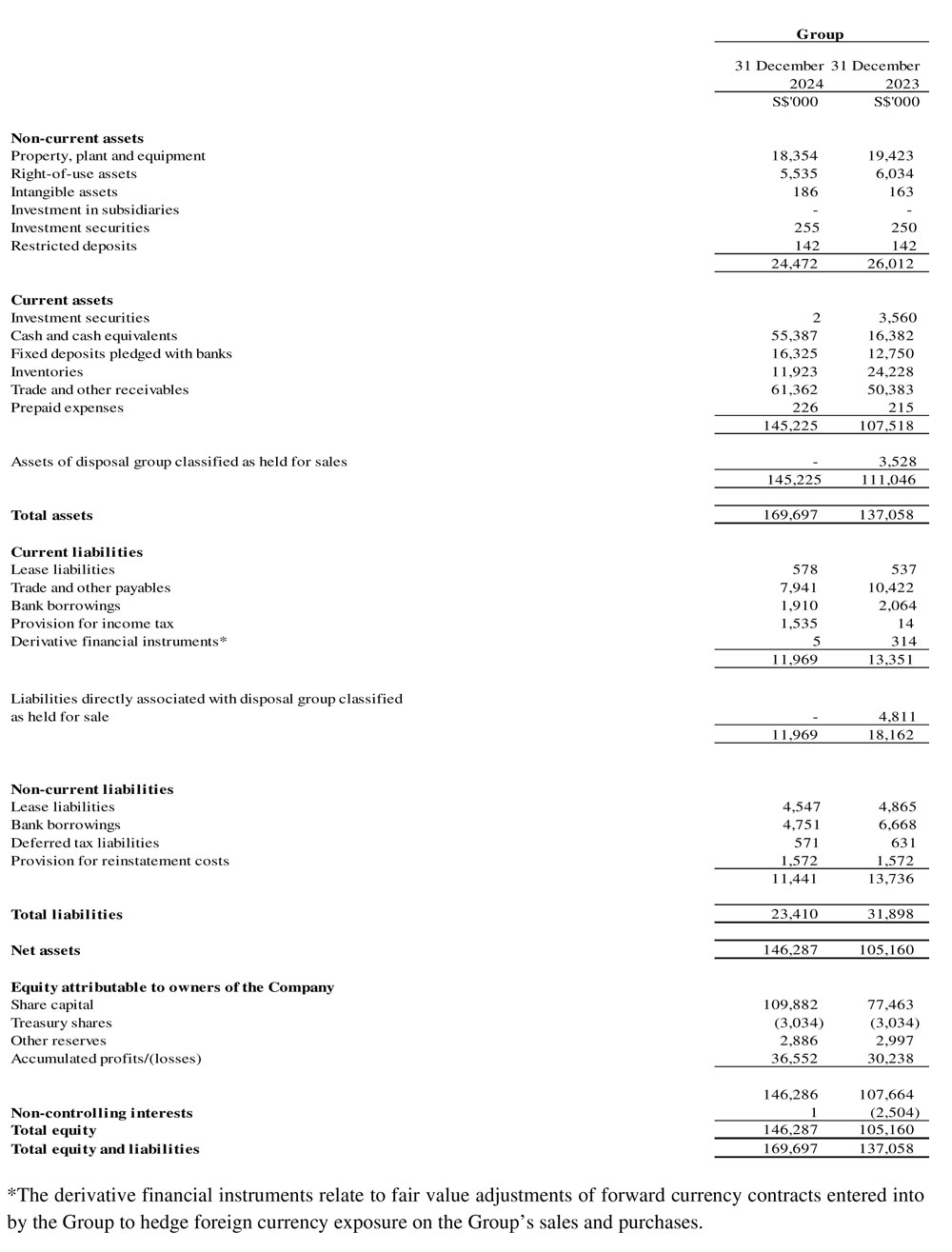

Condensed interim statements of financial position

Review of Performance

-

Review of Performance

Financial performance of the Group (2H2024 vs 2H2023)

Continuing operations

Revenue and Gross Profit

The Group recorded revenue of S$84.8 million in 2H2024 as compared to S$83.5 million in 2H2023, the slight growth in revenue was mainly due to a 13% increase in the sales volume on a year-on-year basis. that was substantially offset by the drop in average selling price of steel in 2H2024 in tandem with the general decline in international steel prices.

The overall gross profit margin for 2H2024 improved to 14.3%, up from 10.4% in 2H2023, mainly due to a lower weighted average cost of material on hand. As a result, the Group achieved a gross profit of S$12.2 million in 2H2024 compared to S$8.7 million in 2H2023.

Other Operating Income

Other operating income increased by 67% in 2H2024 compared to 2H2023 primarily driven by a fair value gain in forward currency contracts and gains from foreign currency exchange.

Selling and Distribution, Administrative, Other Operating and Finance Expenses

The Group’s selling and distribution expenses in 2H2024 were higher than 2H2023 mainly due to increased out-sourced logistic services in line with the increase in sales volume.

Administrative expenses for 2H2024 increased by 20% to S$4.0 million in 2H2024 from S$3.4 million in 2H2023, primarily due to increase in salary cost.

Other operating expenses for 2H2024 decreased to S$1.7 million, down from S$1.9 million in 2H2023. The decline was mainly attributed to lower depreciation expenses.

Total finance costs incurred in 2H2024 which were primarily related to trade financing, term loans from banks, construction loans and leases for properties redevelopment, decreased compared to 2H2023. The reduction was mainly due to lower bank borrowings.

Profitability

The Group reported a net profit before tax of S$5.9 million from continuing operations in in 2H2024, compared to a profit before tax of S$2.9 million in 2H2023. The improved financial results was driven by higher gross profit generated and lower operating expenses incurred in 2H2024.

The income tax expense for 2H2024 was S$0.7 million. In contrast, a tax refund of S$0.3 million for 2H2023 was received due to over payment, resulting in a tax credit for 2H2023.

The Group recorded a net profit after tax of S$5.1 million in 2H2024 compared to a net profit after tax of S$3.2 million in 2H2023 from continuing operations.

Discontinued operations

No financial numbers for the discontinued operation were recorded in 2H2024 as it was divested on 13 February 2024.

Results for FY2024 versus FY2023

Continuing operations

Revenue and Gross Profit

The Group achieved revenue of S$157.9 million in FY2024, compared to S$149.8 million in FY2023. The slight revenue growth was primarily driven by a 19% increase in sales volume, although the gain was partially offset by a decline in average selling prices, in view of the softening of global steel prices compared to same period last year.

The overall gross profit margin for FY2024 increased to 14.0%, up from 8.5% in FY2023. This was mainly attributed to a lower weighted average cost of material on hand. As a result, the Group recorded a higher gross profit of S$22.1 million in FY2024, compared to S$12.8 million in FY2023.

Other Operating Income

Other operating income increased to S$1.7 million in FY2024, up from S$1.0 million in FY2023. This was mainly attributed to a fair value gain in forward currency contracts and a gain on from foreign currency exchange.

Selling and distribution, Administrative, Other Operating and Finance Costs

Total selling and distribution costs incurred rose to S$1.5 million in FY2023 compared to S$0.9 million in FY2023, driven by increased delivery volumes, higher use of outsourced logistics services and a rise in transport charges.

Administrative expenses increased to S$8.0 million in FY2024 compared to S$7.4 million mainly due to increase in staff cost.

Other operating expenses for FY2024 decreased to S$3.4 million, down from S$4.2 million in the previous financial year, primarily due to lower depreciation expenses.

Total finance costs incurred amounted to S$0.6 million in FY2024, compared to S$1.0 million in FY2023. The decrease was mainly due to lower bank borrowings.

The Group recorded a reversal of impairment loss on financial assets of S$0.04 million in FY2024 as compared to an impairment loss of S$0.08 million in FY2023 as the customers repaid the previously impaired amounts.

Profitability

The Group reported a net profit before tax from continuing operations of S$10.3 million in FY2024 up from a net profit before tax of S$0.1 million in FY2023 mainly driven by an increase in gross profit.

The income tax expense for FY2024 was S$1.5 million. In FY2023, the Group recognized a tax credit of S$0.3 million, resulting from a refund due to overpaid taxes.

The Group recorded a net profit after tax from continuing operations of S$8.8 million in FY2024, compared to a net profit after tax of S$0.5 million in FY2023.

Discontinued operations

The Group recorded a net loss after tax of S$264,000 in FY2024 for its discontinued operation. The discontinued operation was divested on 13 February 2024.

-

Balance Sheet

The Group’s non-current assets, which comprised mainly property, plant and equipment and right-of-use assets were S$24.5 million as of 31 December 2024 compared to S$26.0 million as at 31 December 2023.

As of 31 December 2024, the Group’s inventory on hand reduced to S$11.9 million from S$24.2 million as at 31 December 2023 which is in line with the Group’s strategy to optimize its inventory holding.

Trade and other receivables amounted to S$61.4 million as of 31 December 2024, compared to S$50.4 million as at 31 December 2023. The increase of S$11.0 million was mainly attributed to an increase in trade receivables in line with higher revenue generated in FY2024. The Group will continue to closely track and manage its trade receivables.

Trade and other payables decreased to S$7.9 million as of 31 December 2024, down from S$10.4 million as of 31 December 2023 mainly due to repayments made to suppliers.

Total bank borrowings decreased to S$6.7 million as of 31 December 2024 from S$8.7 million as of 31 December 2023 mainly due to loan repayments.

-

Statement of Cash Flows

The Group generated cash flows from operating activities of S$11.5 million in FY2024. This was due to profits from operations, offset by net decrease in working capital, primarily due to an increase in trade and other receivables.

Net cash used in investing activities for FY2024 amounted to S$2.2 million. This included mainly S$3.6 million for fixed deposit pledged with banks, S$0.9 million for purchase of property, plant and equipment and intangible assets as well as S$1.4 million in net cash outflow for the disposal of a subsidiary. These outflows were partially offset by S$3.5 million in proceeds from maturity of investment securities and S$0.1 million in proceeds from disposal of property, plant and equipment.

Net cash inflows from financing activities for FY2024 totaled S$29.7 million. This amount included net proceeds of S$13.0 million from a share placement and S$19.4 million from a rights issue after accounting for S$2.1 million in banks borrowings repayment and S$0.6 million in principal lease repayments.

The Group’s cash and cash equivalents increased to S$55.4 million as at 31 December 2024, up from S$16.5 million as at 31 December 2023.

-

Commentary

The Building and Construction Authority (BCA) has projected Singapore's construction demand for 2025 to range between S$47 billion and S$53 billion, driven by major projects such as the Changi Airport Terminal 5, Marina Bay Sands expansion, public housing, healthcare and educational facilities, and infrastructure developments like MRT projects and Tuas Port. In real terms, demand is expected to be between S$35 billion and S$39 billion, slightly surpassing pre-COVID levels. Looking ahead, BCA anticipates an average annual construction demand of S$39 billion to S$46 billion from 2026 to 2029, underpinned by ongoing and upcoming infrastructure and development projects.

Singapore's GDP grew by 4.4% in 2024, signaling a positive economic trajectory. This growth was driven by strong performances across key sectors, including wholesale trade, finance and insurance, and manufacturing. Additionally, the construction sector expanded by 4.5%, building on the 5.8% growth achieved in 2023.

However, the Ministry of Trade and Industry (MTI) has maintained its GDP growth forecast for 2025 at a more modest 1.0% to 3.0%. This projection reflects a more measured pace of growth compared to the robust 4.4% expansion in 2024. MTI attributes the cautious outlook to significant global economic uncertainties, including trade tensions and geopolitical conflicts, which could pose risks to Singapore’s trade-dependent economy.

Hence, while BCA's outlook for construction demand remains positive, the more subdued GDP forecast for 2025 could present challenges for the construction sector as the potential realization of global economic risks and geopolitical uncertainties may impact the sector's growth path.

The Group’s business fundamentals will continue to be supported by the growth of the Singapore construction sector. The Group posted a business volume growth of 19% in FY2024 compared to FY2023 and a net profit after tax of S$8.6 million in FY2024, signifying our unwavering effort to pursue business growth and ensure a turnaround from the loss position of S$1.8 million recorded in FY2023. This performance underscores our commitment to creating long-term value for our shareholders.

In FY2024, the Group completed a share placement and rights issue exercise to raise funds of approximately S$32.4 million (net of the related expenses incurred), which strengthened our balance sheet and positioned us for further growth opportunities.

Meanwhile, effective 3 February 2025 Green Esteel Pte Ltd has become the majority shareholder of the Group following the successful completion of a mandatory general cash offer. With its robust financial position, extensive business networks, and deep understanding of the regional business landscape, we are confident that this partnership will create valuable synergies, expand our capabilities and support the Group’s long-term growth strategy.