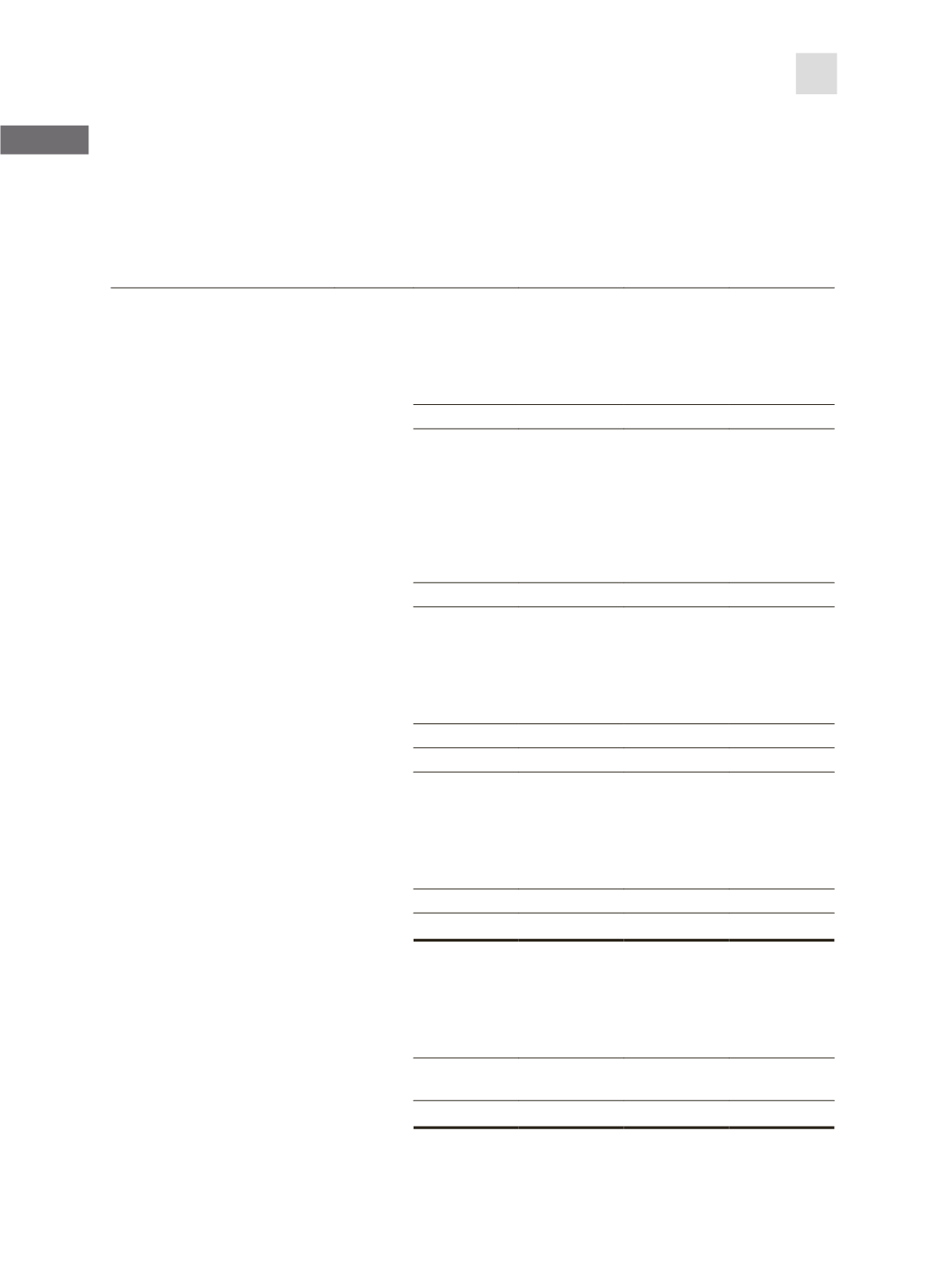

47

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2014

BALANCE

SHEETS

as at 31 December 2014

Group

Company

Note

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Non-current assets

Property, plant and equipment

10

15,652

18,277

8,215

8,457

Intangible assets

11

79

340

75

326

Investment in subsidiaries

12

–

–

13,147

13,488

Investment in associates

13

49,488

48,628

68

713

Deferred tax assets

16

12

–

–

–

65,231

67,245

21,505

22,984

Current assets

Investment held for trading

14

110

53

–

–

Derivative financial instruments

15

–

44

–

34

Inventories

17

28,058

96,705

25,645

79,015

Trade and other receivables

18

35,549

55,495

49,906

85,597

Income tax recoverable

135

115

–

–

Prepaid expenses

184

281

145

154

Cash and cash equivalents

19

52,661

16,123

45,222

8,754

116,697

168,816

120,918

173,554

Current liabilities

Trade and other payables

20

25,471

24,913

29,643

30,848

Finance lease payables

21

44

66

–

–

Bank borrowings

22

5,857

51,052

5,857

44,860

Deferred income

23

1,429

1,429

1,429

1,429

Provision for income tax

13

77

–

–

32,814

77,537

36,929

77,137

Net current assets

83,883

91,279

83,989

96,417

Non-current liabilities

Finance lease payables

21

23

65

–

–

Bank borrowings

22

6,855

11,035

6,855

11,035

Deferred tax liabilities

16

–

9

–

–

Deferred income

23

5,833

7,262

5,833

7,262

Provision for reinstatement costs 24

1,000

1,000

700

700

13,711

19,371

13,388

18,997

135,403

139,153

92,106

100,404

Equity attributable to owners

of the Company

Share capital

25

152,052

137,314

152,052

137,314

Treasury shares

26

(1,885)

(1,885)

(1,885)

(1,885)

Other reserves

27

1,931

2,150

2,527

2,527

Accumulated losses

(17,259)

(100)

(60,588)

(37,552)

134,839

137,479

92,106

100,404

Non-controlling interests

564

1,674

–

–

Total equity

135,403

139,153

92,106

100,404

The accompanying accounting policies and explanatory notes form an integral part of the financial statements.