79

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2014

NOTES TO THE

FINANCIAL STATEMENTS

for the financial year ended 31 December 2014

8.

INCOME TAX CREDIT (CONT’D)

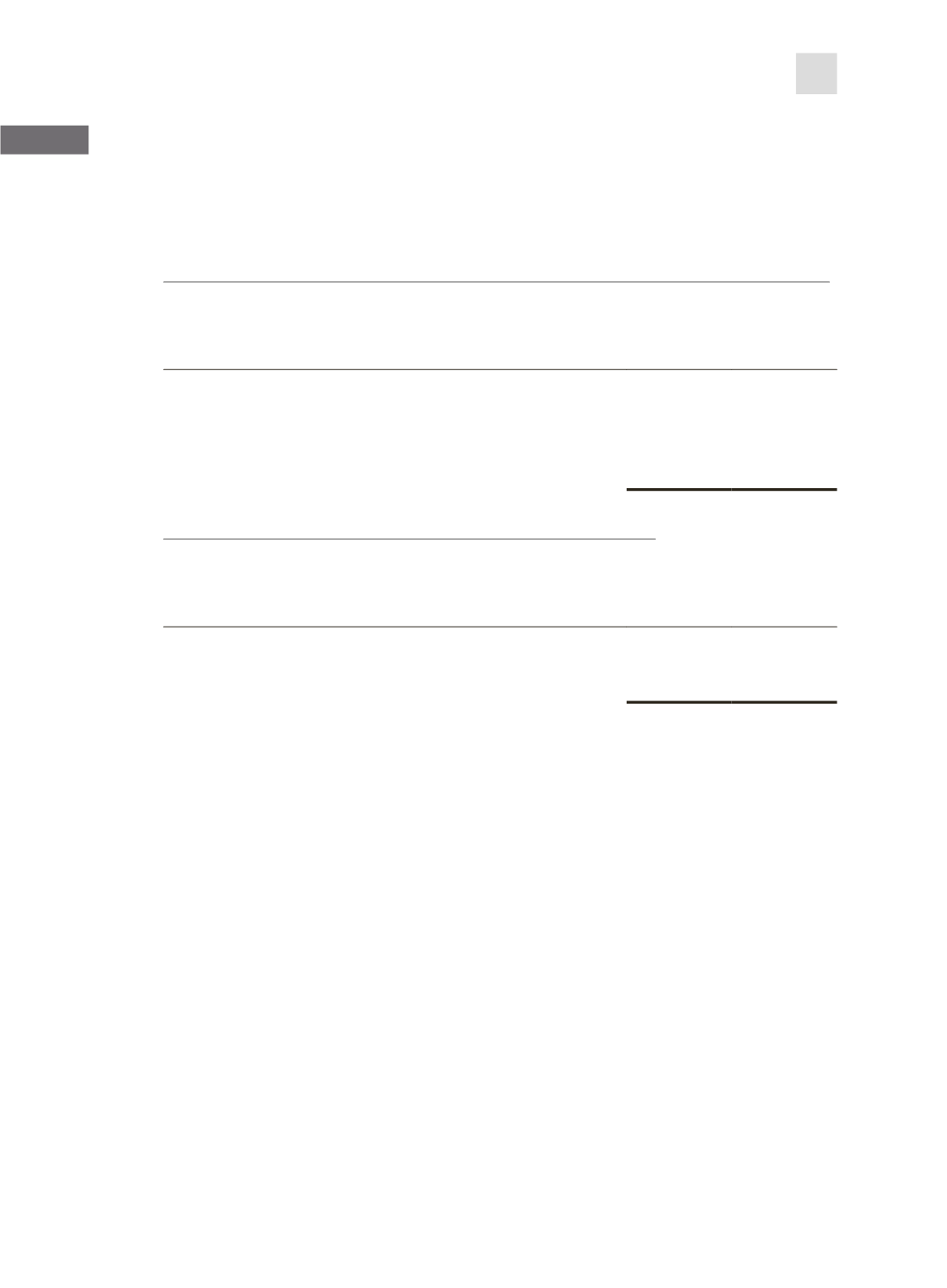

The tax effects of expenses that are not deductible for income tax purposes include the following:

Group

2014

2013

$’000

$’000

Depreciation of property, plant and equipment

343

289

Amortisation of intangible assets

5

13

Upkeep of motor vehicles

6

54

Impairment of property, plant and equipment

204

–

Interest expense

10

–

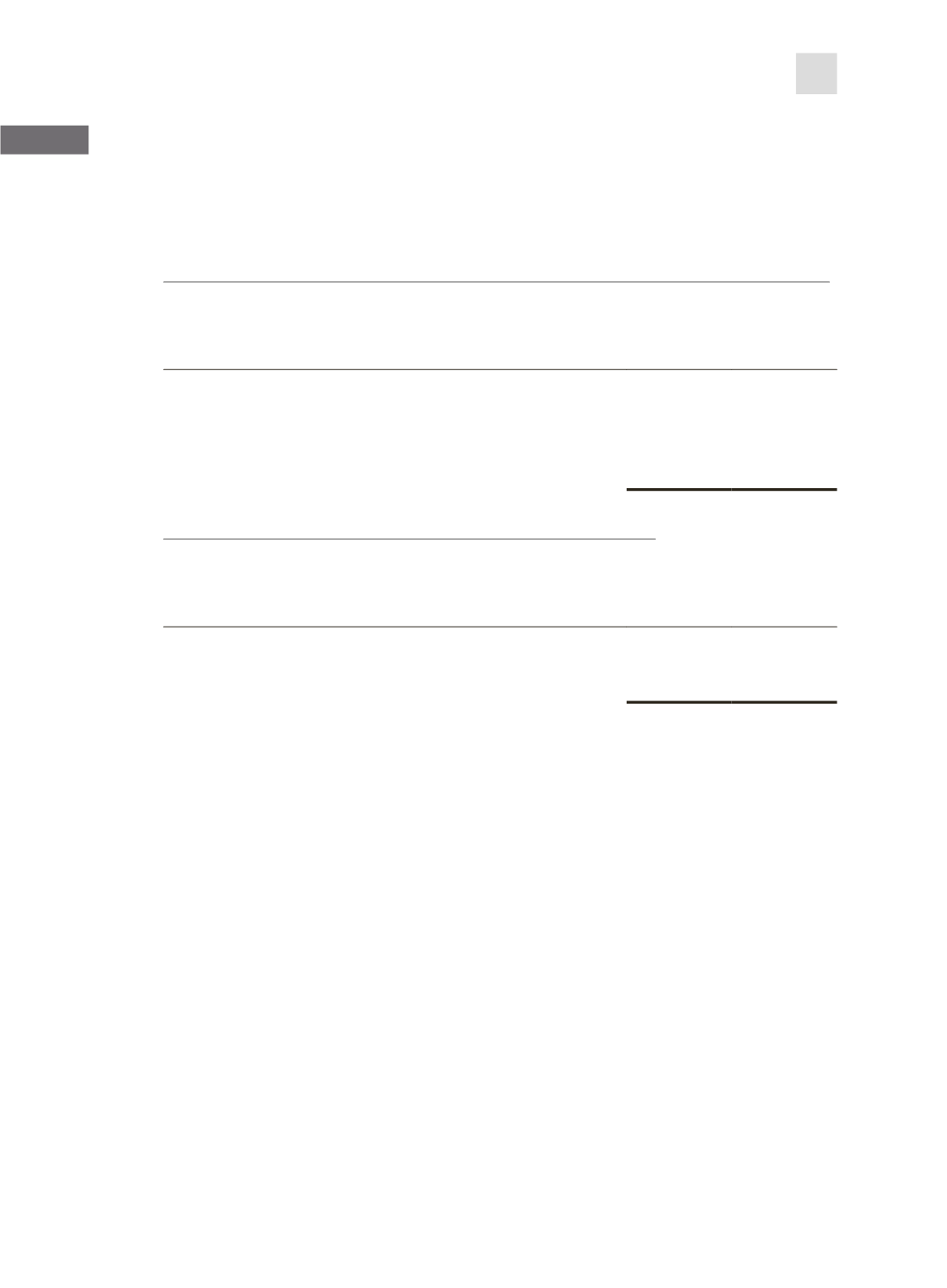

The tax effects of income that is not subject to tax include the following:

Group

2014

2013

$’000

$’000

Fair value gain on derivatives

–

6

Gain on disposal of property, plant and equipment

23

6

Recognition of deferred income

243

223

9.

EARNINGS PER SHARE

Basic earnings per share are calculated by dividing the Group’s (loss)/profit for the year attributable

to owners of the Company by the weighted average number of ordinary shares outstanding during

the financial year.

Diluted earnings per share are calculated by dividing the Group’s (loss)/profit for the year attributable

to owners of the Company by the weighted average number of ordinary shares outstanding during

the financial year plus the weighted average number of ordinary shares that would be issued on the

conversion of all the dilutive potential ordinary shares into ordinary shares.