93

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2014

NOTES TO THE

FINANCIAL STATEMENTS

for the financial year ended 31 December 2014

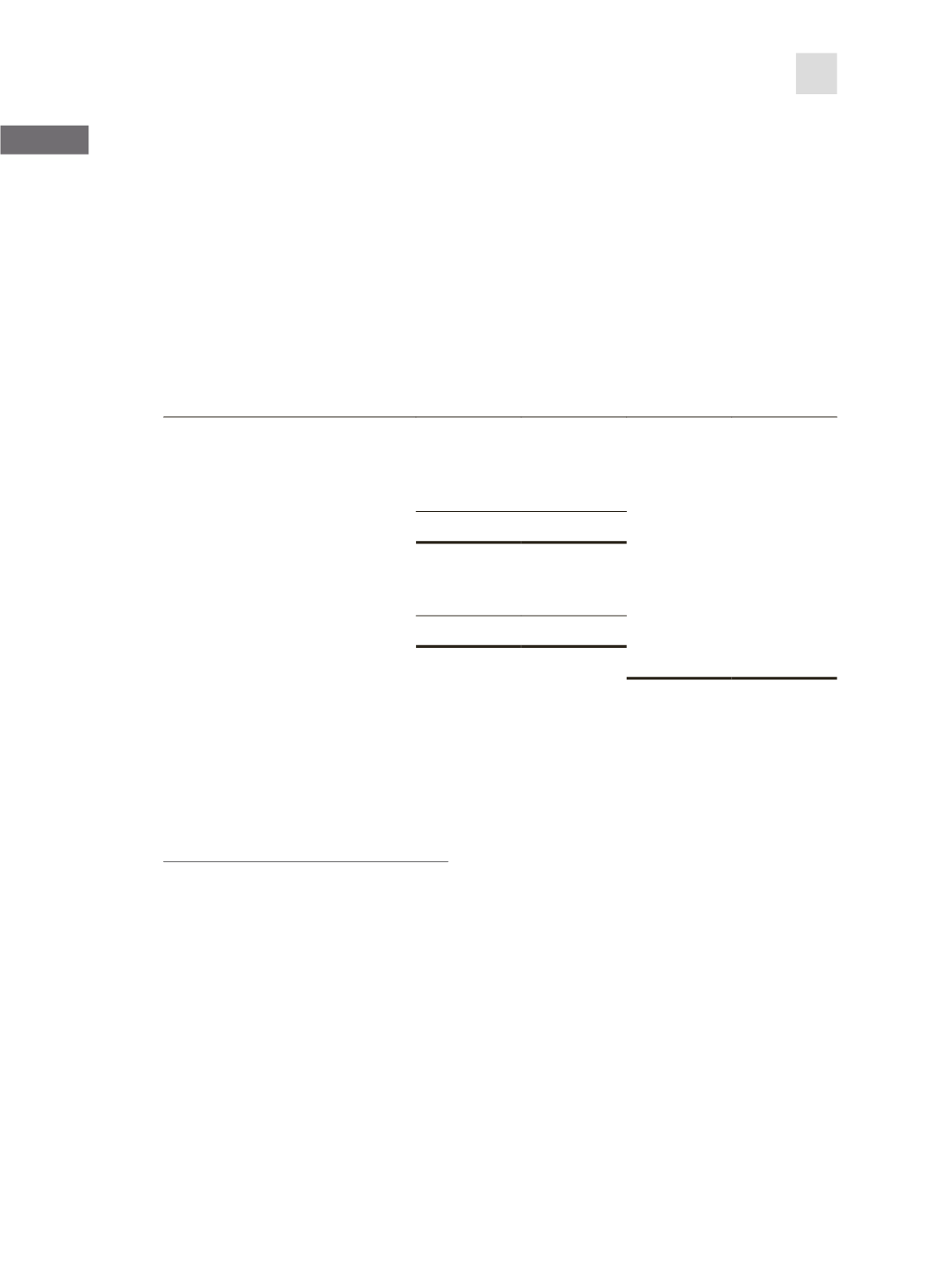

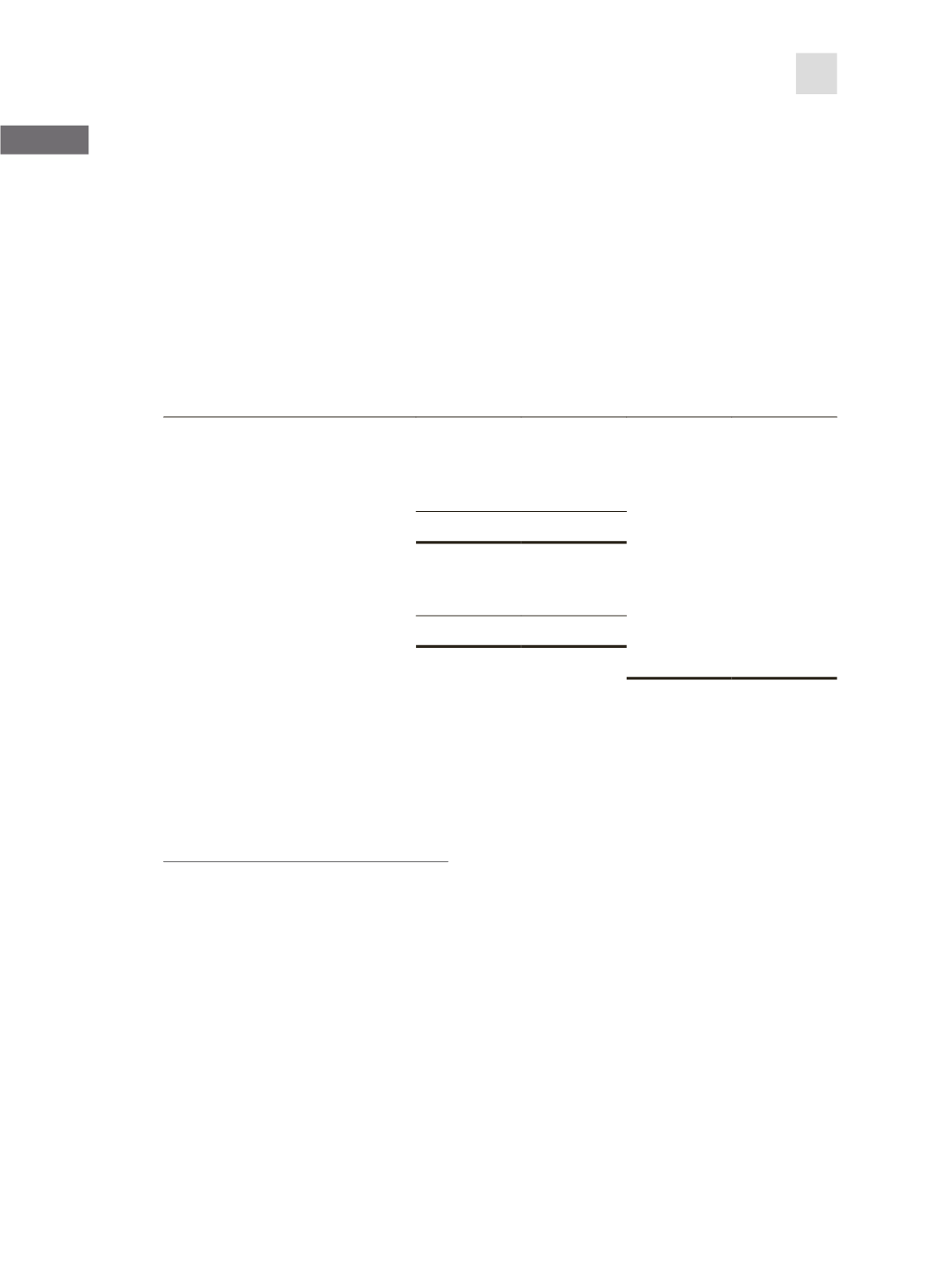

16.

DEFERRED TAX

Deferred income tax relates to the following:

Group

Consolidated

balance sheet

Consolidated statement of

comprehensive income

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Deferred tax liabilities:

Differences in depreciation for

tax purposes

–

9

(9)

(178)

–

9

Deferred tax assets:

Provisions

12

–

(12)

–

12

–

Deferred income tax credit

(21)

(178)

At the balance sheet date, the Group has tax losses of approximately $101,510,000 (2013:

$82,280,000) that are available for offset against future taxable profits of the companies in which the

losses arose, for which no deferred tax asset is recognised due to uncertainty of its recoverability.

The use of these tax losses is subject to the agreement of the tax authorities and compliance with

certain provisions of the tax legislation of the respective countries in which the companies operate.

Tax consequences of proposed dividends

There are no income tax consequences attached to the dividends to the shareholders proposed by

the Company but not recognised as a liability in the financial statements (Note 31).