111

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2014

NOTES TO THE

FINANCIAL STATEMENTS

for the financial year ended 31 December 2014

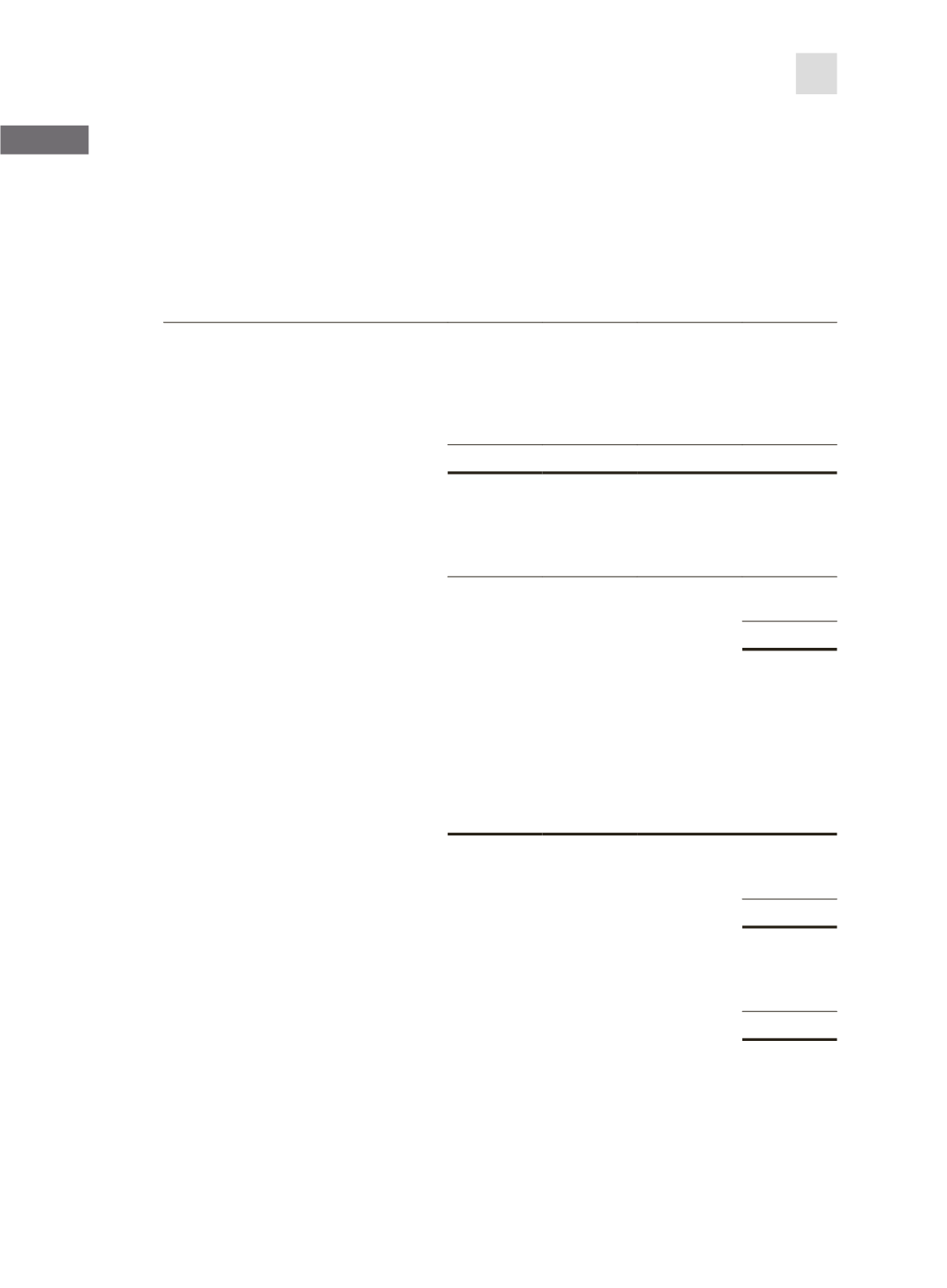

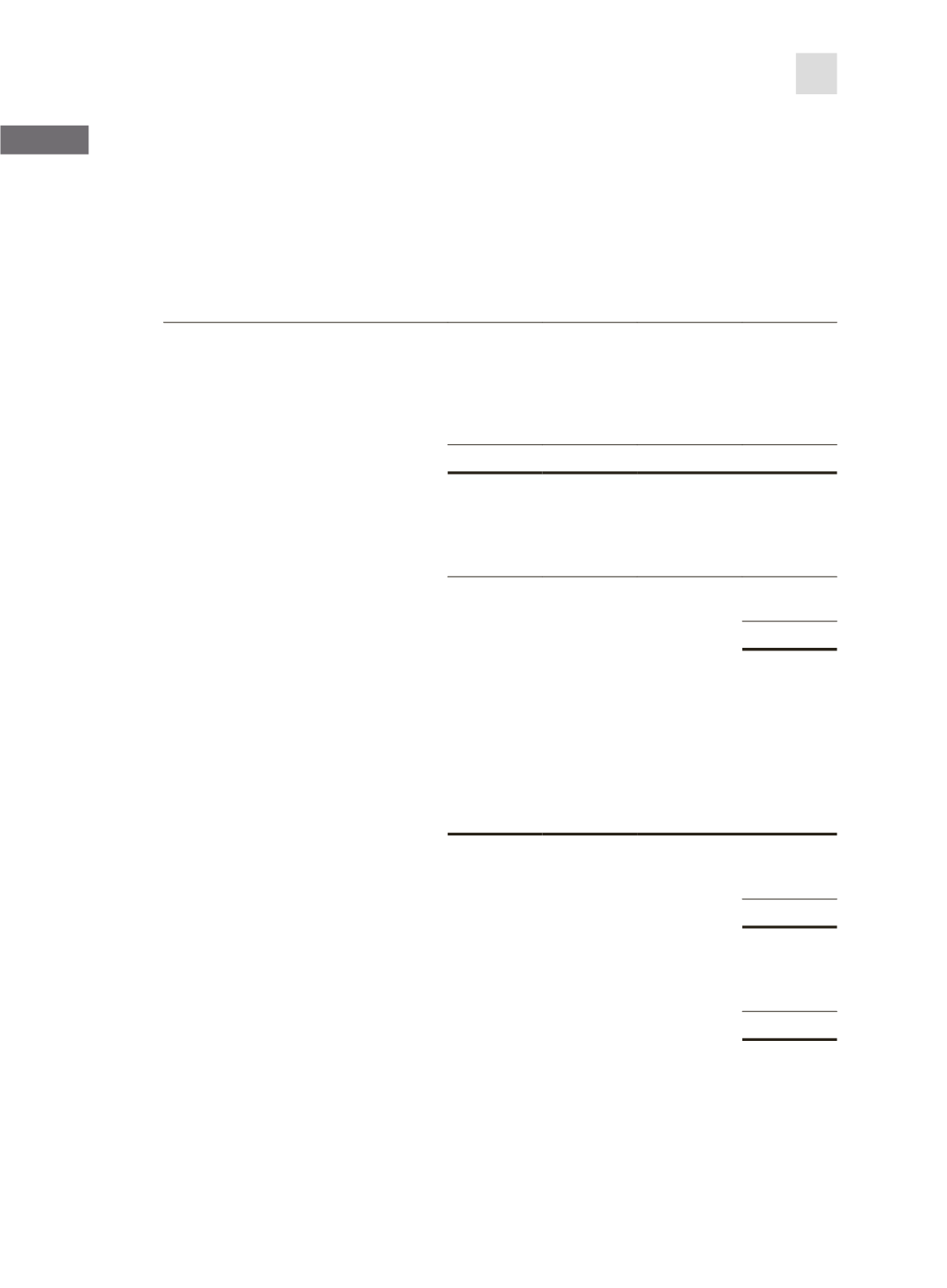

30.

SEGMENT INFORMATION (CONT’D)

Trading

Manu-

facturing

Adjustment/

elimination

Group

$’000

$’000

$’000

$’000

Financial year ended

31 December 2013

REVENUE

Sales to external customers

228,733

37,313

–

266,046

Inter-segment sales (Note A)

32,346

20,957

(53,303)

–

Total

261,079

58,270

(53,303)

266,046

RESULTS

Profit/(loss) from operations (Note C)

526

(960)

(3,617)

(4,051)

Interest expense

(1,535)

(234)

42

(1,727)

Interest income

193

1

(42)

152

Share of associate results

249

8,581

–

8,830

Segment (loss)/profit

(567)

7,388

(3,617)

3,204

Income tax credit

55

Profit for the year

3,259

OTHER INFORMATION

Debit/(Credit):

Investment in associates

1,124

47,504

–

48,628

Additions to non-current assets (Note B)

1,898

1,911

(82)

3,727

Depreciation and amortisation of

assets

1,571

1,025

(242)

2,354

Recognition of deferred income

(1,309)

–

–

(1,309)

Write down of inventories

39

–

–

39

Fair value gain from derivatives

(12)

(22)

–

(34)

ASSETS AND LIABILITIES

Segment assets (Note A)

268,513

37,460

(70,027)

235,946

Income tax recoverable

115

Total assets

236,061

Segment liabilities (Note A)

153,405

19,239

(75,822)

96,822

Tax payable

77

Deferred tax liabilities

9

Total liabilities

96,908

Notes:

(A) Segment assets and liabilities include balances with companies in the Group. Inter-segment sales, assets and

liabilities are eliminated on consolidation.

(B) Additions to non-current assets consist of additions to property, plant and equipment and intangible assets.

(C) Other non-cash expenses consist of inventories written-down, provisions, and impairment of financial assets

as presented in the respective notes to the financial statements.