116

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2014

NOTES TO THE

FINANCIAL STATEMENTS

for the financial year ended 31 December 2014

33.

FAIR VALUE OF ASSETS AND LIABILITIES (CONT’D)

Fair value hierarchy (cont’d)

(a)

Assets and liabilities measured at fair value (cont’d)

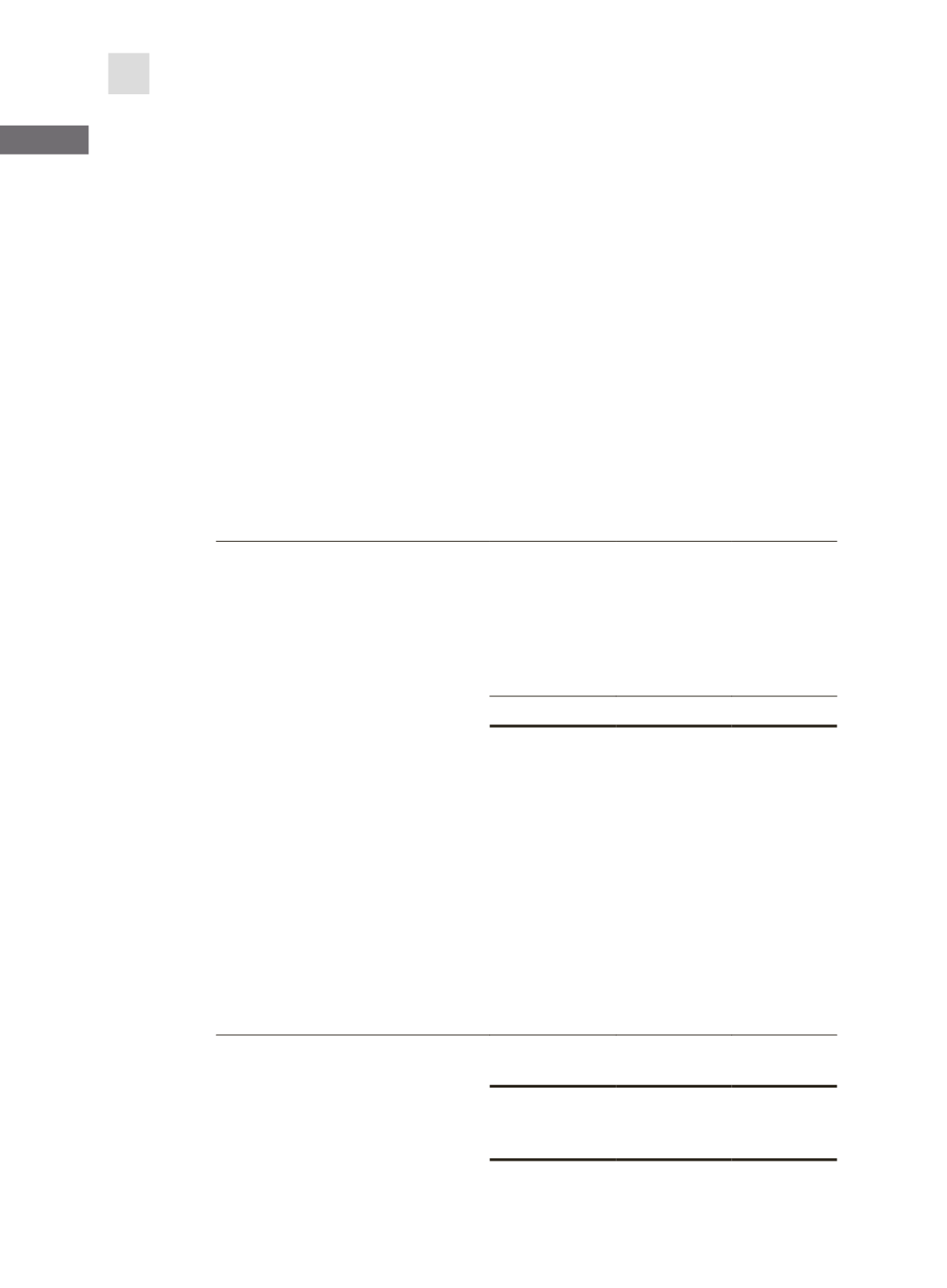

Group

2013

$’000

Quoted prices

in active

markets for

identical

instruments

Significant

observable

inputs other

than quoted

prices

Total

(Level 1)

(Level 2)

Recurring fair value measurements

Assets

Financial assets:

Investment held for trading

– Equity instruments (quoted)

53

–

53

Derivative financial instruments

– Forward currency contracts

–

44

44

As at 31 December 2013

53

44

97

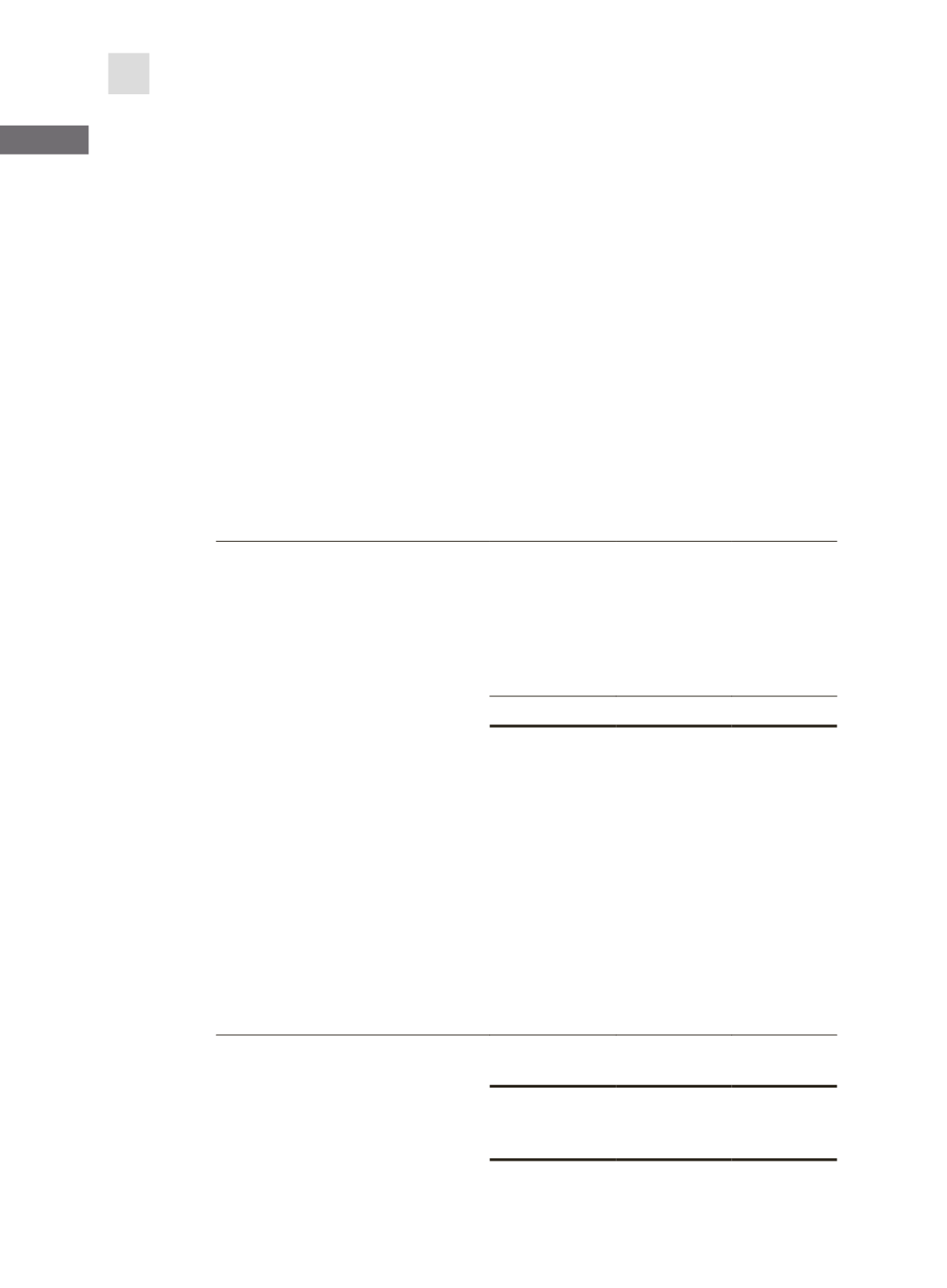

(b)

Assets and liabilities not carried at fair value but for which fair value is disclosed

The following table shows an analysis of the Group’s assets and liabilities not measured at

fair value at 31 December 2014 and 2013 but for which fair value is disclosed:

Group

2014

$’000

Quoted prices

in active

markets for

identical assets

Significant

unobservable

inputs

Carrying

amount

(Level 1)

(Level 3)

Assets

Investment in associate (BRC)

36,667

–

49,428

Liabilities

Obligations under finance leases

–

63

67

Bank borrowings

–

12,229

12,712