19.

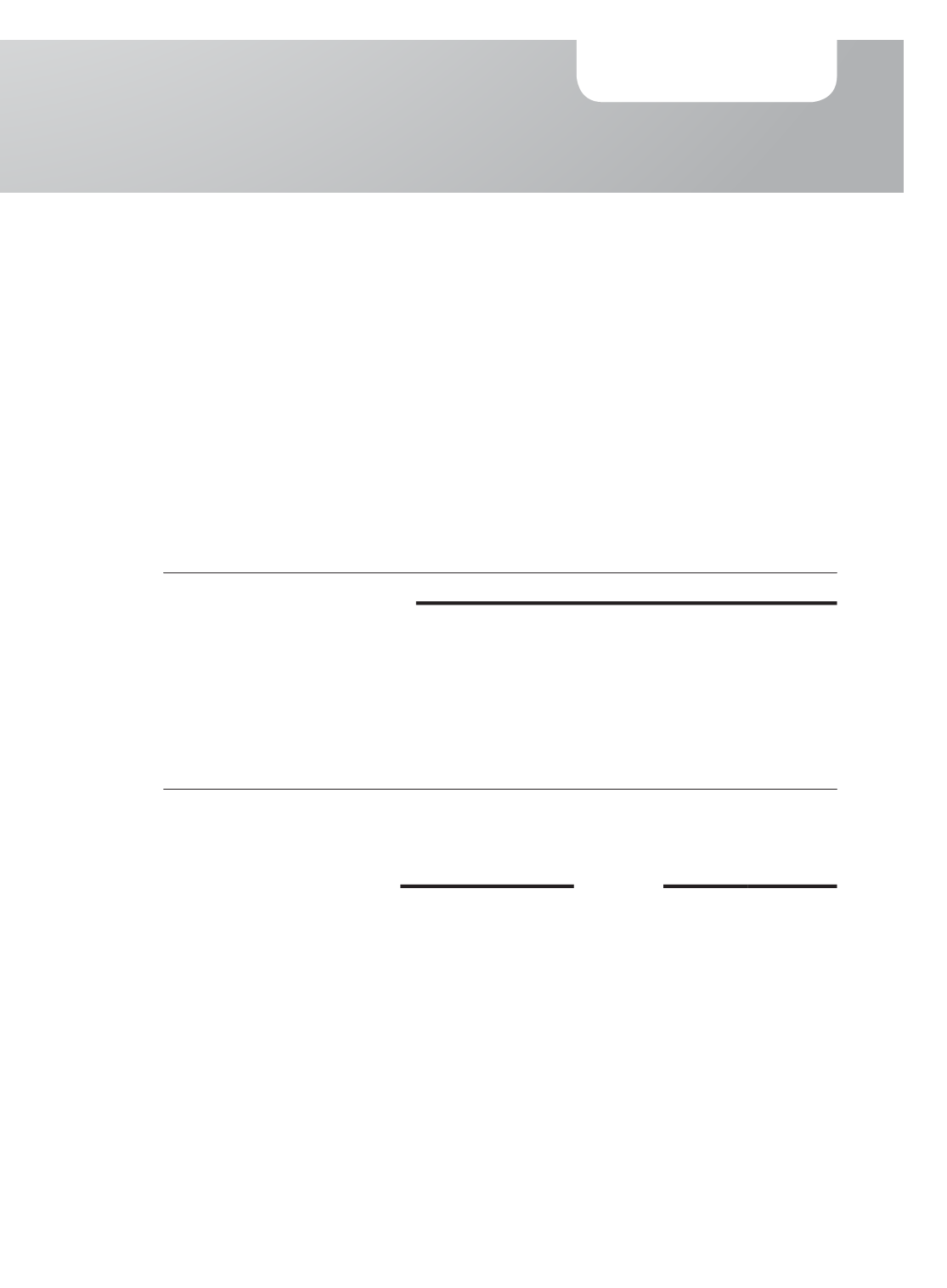

TRADE AND OTHER PAYABLES (CONTINUED)

Trade payables including amounts due to subsidiaries and associates are non-interest bearing and

are normally settled on 30 to 90 days’ term.

The non-trade amounts, including amounts due to subsidiaries and related parties are unsecured,

interest-free, repayable on demand and expected to be settled in cash.

Deposits from customers are trade related, unsecured and settled upon the fulfilment of the

contractual obligations.

Trade payables denominated in foreign currencies at 31 December are as follows:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

United States Dollar

2,556

12,683

2,555

12,681

20.

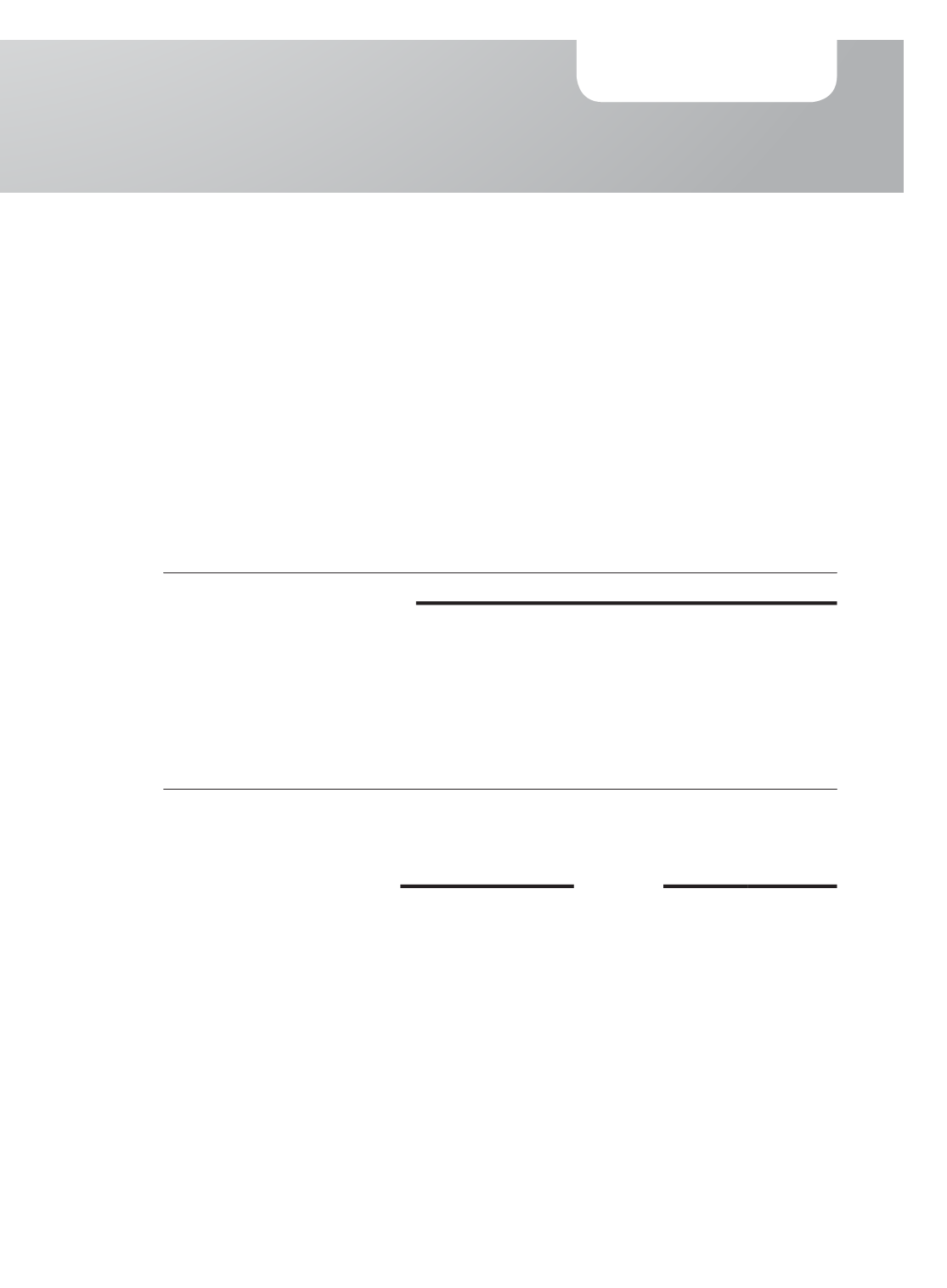

DERIVATIVE FINANCIAL INSTRUMENTS

Contract/

Notional

Amount

2015

Contract/

Notional

Amount

2014

$’000

$’000

$’000

$’000

Assets Liabilities

Assets Liabilities

Group and Company

Forward currency

contracts

19,618

–

59

–

–

–

Forward currency contracts are used to hedge foreign currency risk arising from the Group’s sales

and purchases denominated in USD for which firm commitments which existed at the end of the

prior reporting year.

99

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015