23.

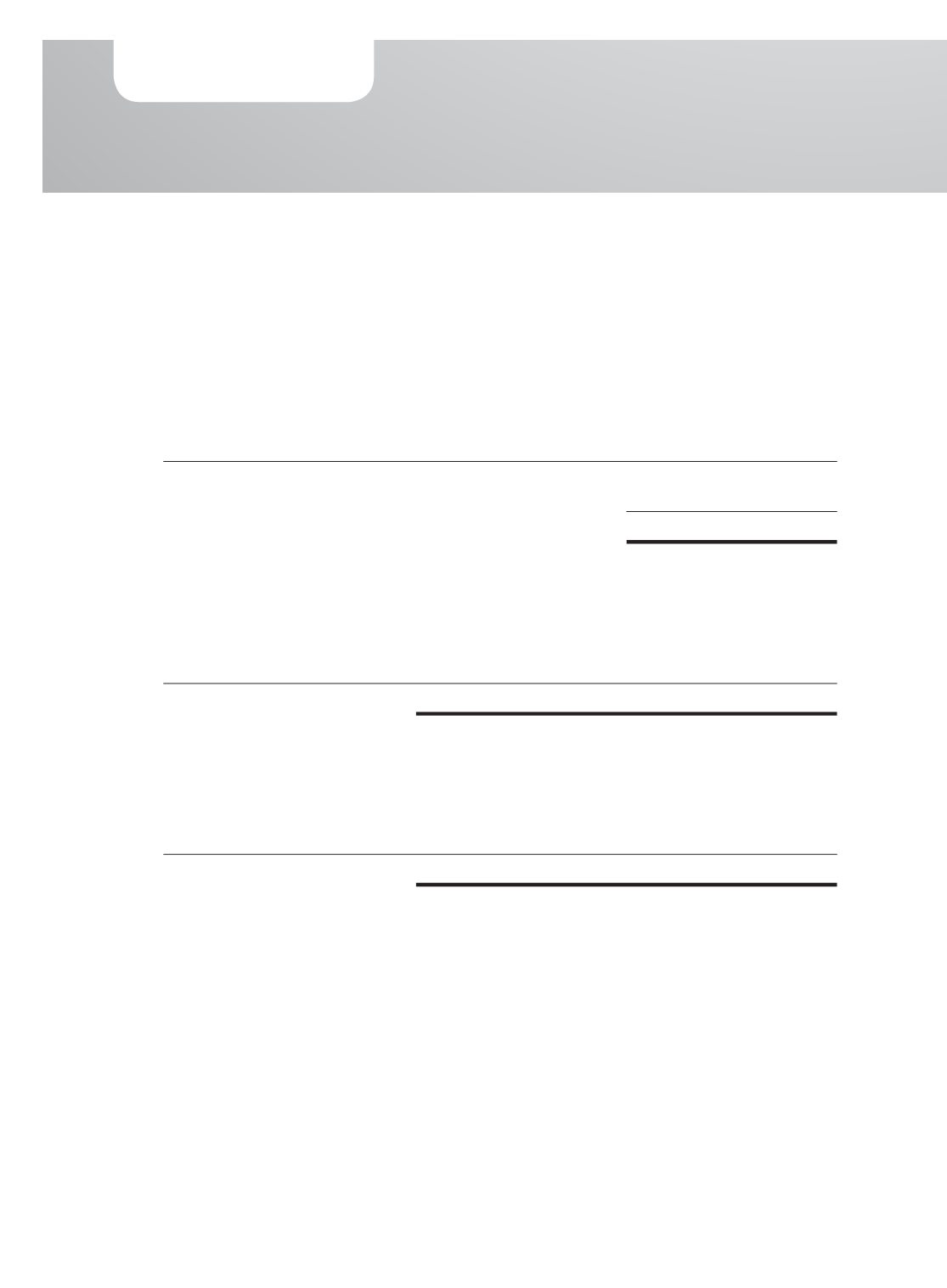

DEFERRED INCOME

Deferred income represents the excess of sale price over the estimated fair value of the leasehold

property at 15 Jurong Port Road arising from the sale and leaseback of the property. The fair value

of the leasehold property was determined by an external valuation using a Direct Sale Comparison

Approach valuation method. The deferred income of $10 million is amortised to profit or loss over

the seven year lease period commencing February 2013. Deferred income is classified as follows:

Group and Company

2015

2014

$’000

$’000

Current

1,429

1,429

Non-current

4,405

5,833

5,834

7,262

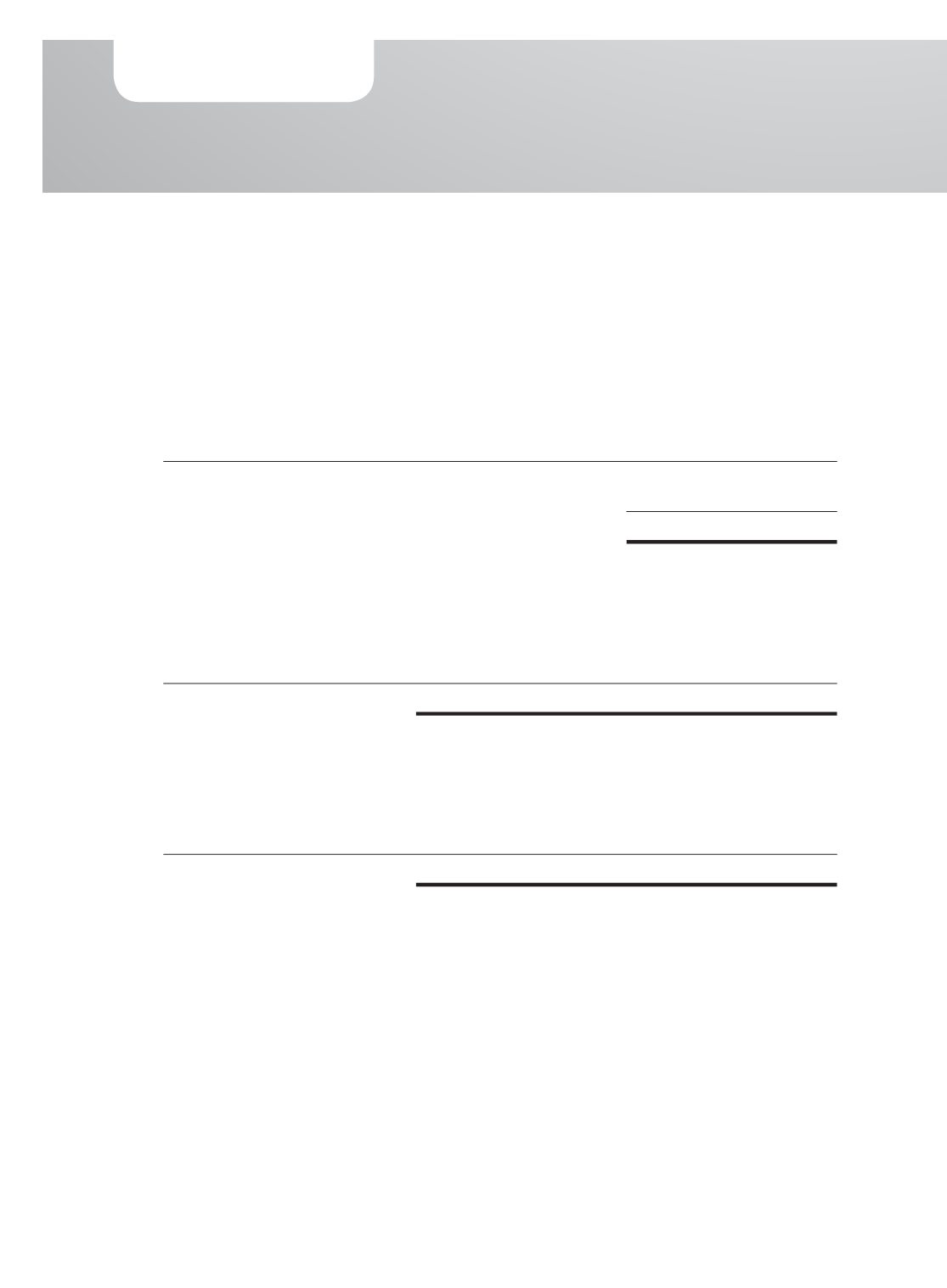

24.

PROVISION FOR REINSTATEMENT COSTS

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Provision for reinstatement costs

1,000

1,000

700

700

The movement in provision for reinstatement costs is as follows:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

At 1 January and 31 December

1,000

1,000

700

700

Provision for reinstatement costs is made in respect of the Group and Company’s leasehold properties

to fulfil the obligations under the lease agreements. Outflows are expected only at the end of the

lease tenure of the leasehold properties in year 2020 (2014: 2020).

102

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015