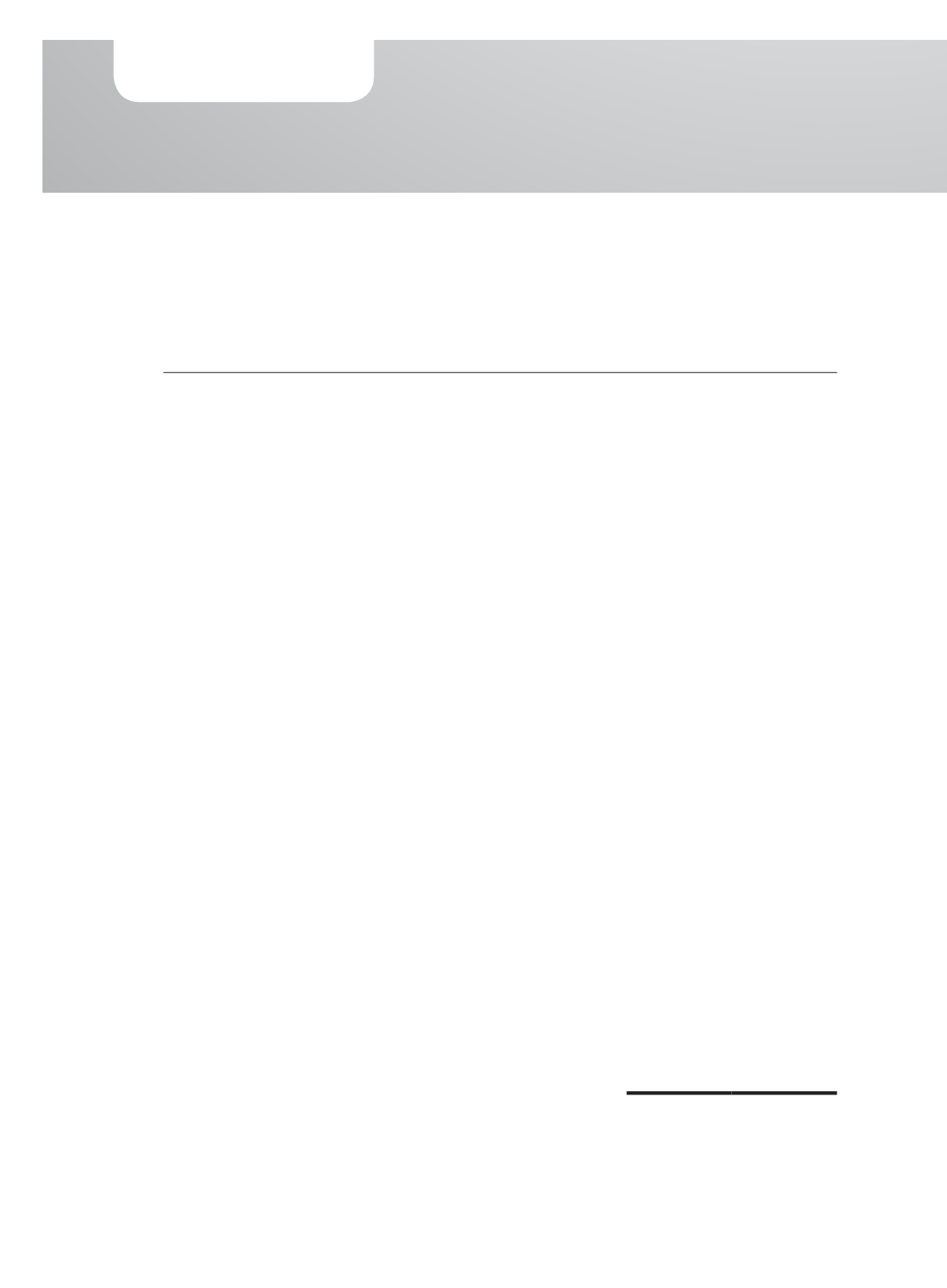

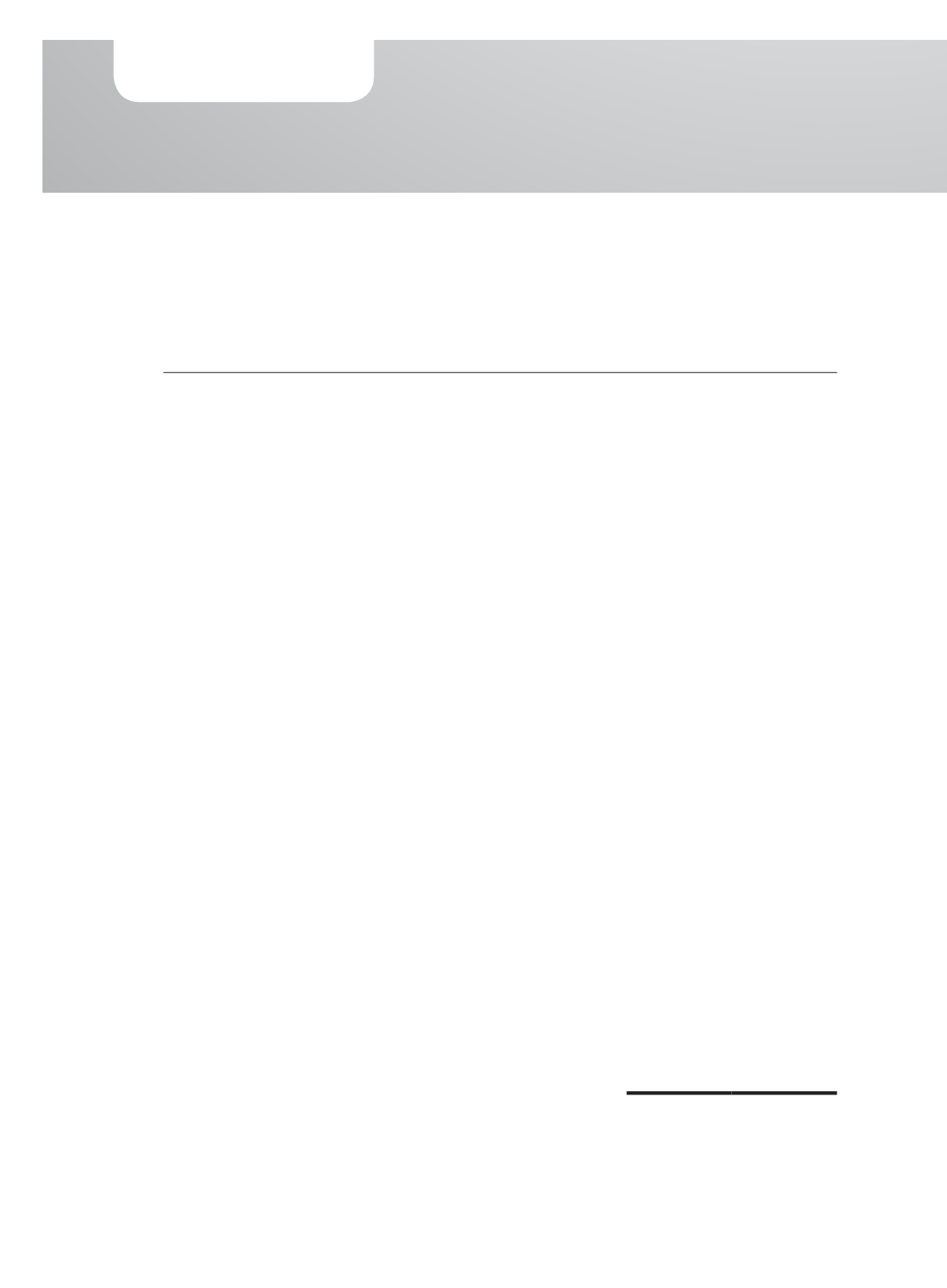

7.

LOSS BEFORE INCOME TAX

Loss before income tax is arrived at after charging the following:

Group

2015

2014

$’000

$’000

Depreciation of property, plant and equipment recognised as an

expense in cost of sales

700

611

Inventories recognised as an expense in cost of sales (Note 16)

118,527

165,048

Operating lease expenses recognised as an expense in cost of sales

485

139

Audit fees paid/payable to:

– Auditors of the Company

217

224

– Other auditors

21

21

Non-audit fees paid/payable to:

– Auditors of the Company

7

–

Directors fees payable to:

– Directors of the Company

234

210

Staff cost (including directors)

– Salaries, bonuses and allowances

5,342

7,246

– Employer’s contributions to defined contribution plan

483

480

– Other staff welfare expenses

223

288

Legal and professional fees

417

416

Consultancy fees

–

1

Included in other operating expenses:

Foreign exchange loss, net

7

–

Depreciation of property, plant and equipment

1,720

1,855

Amortisation of intangible assets

31

40

Loss on disposal of intangible assets

–

69

Property, plant and equipment written off

46

76

Impairment of property, plant and equipment

538

1,659

Write down of inventories to net realisable value

2,144

9,783

Write off of inventories

34

638

Allowance made for doubtful trade receivables

264

2,714

Bad debts written off

7

237

Operating lease expenses

6,213

6,334

Fair value loss on forward currency contracts

59

45

Other receivables written off

–

368

78

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015