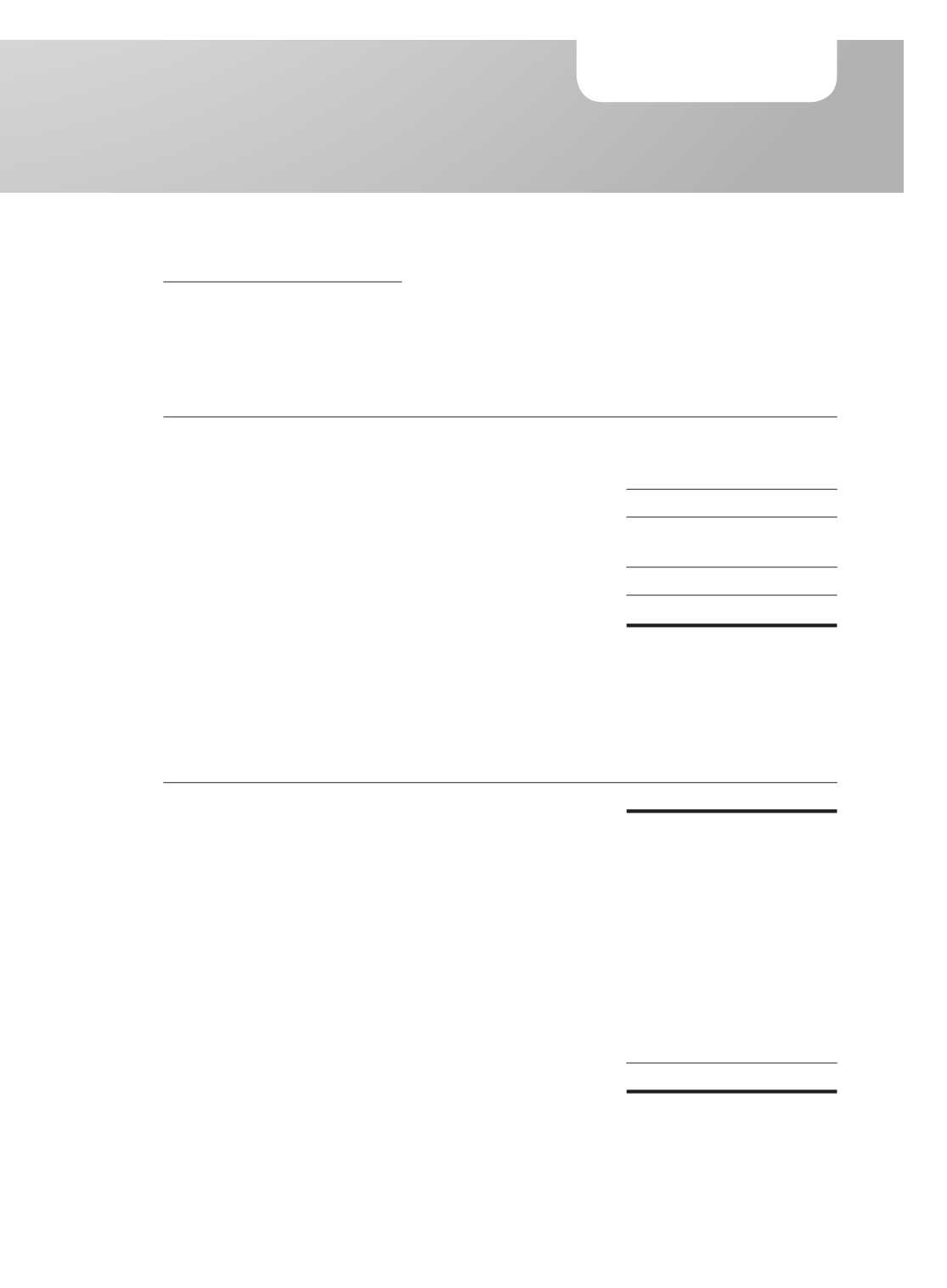

8.

INCOME TAX EXPENSE/(CREDIT)

Major components of income taxes

The major components of income taxes for the years ended 31 December 2015 and 2014 are:

Group

2015

2014

$’000

$’000

Current income tax

– Current financial year

–

4

– Over provision in respect of prior periods

–

(166)

–

(162)

Deferred tax

– Under/(over) provision in respect of prior periods

12

(21)

12

(21)

Total income tax expense/(credit) recognised in profit or loss

12

(183)

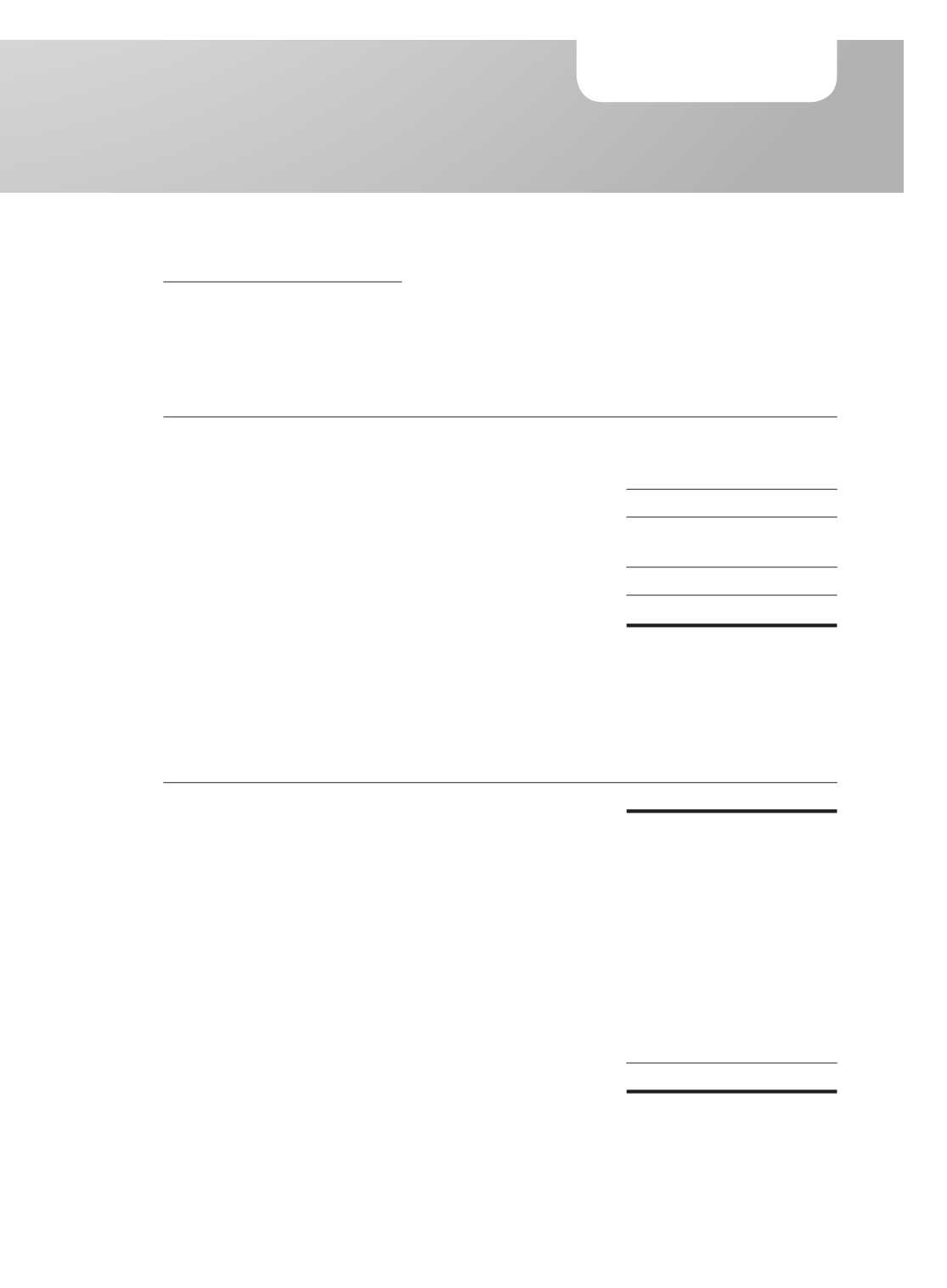

The reconciliation between tax expense/(credit) and the product of accounting loss multiplied by the

applicable corporate tax rate for the years ended 31 December 2015 and 2014 is as follows:

Group

2015

2014

$’000

$’000

Loss before income tax

(5,636)

(16,934)

Tax at the domestic rates applicable to profits in the countries

where the Group operates

(885)

(3,226)

Tax effect of:

– expenses not deductible for tax purposes

1,091

602

– income not subject to tax

(272)

(278)

Under/(over) provision in respect of prior periods

12

(187)

Tax exemption and tax relief

(30)

(38)

Enhanced tax deduction

(3)

–

Deferred tax assets not recognised

721

3,904

Benefits from previously unrecognised tax losses

(114)

(156)

Share of associates results

(516)

(783)

Others

8

(21)

12

(183)

The above reconciliation is prepared by aggregating separate reconciliations for each national

jurisdiction.

79

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015