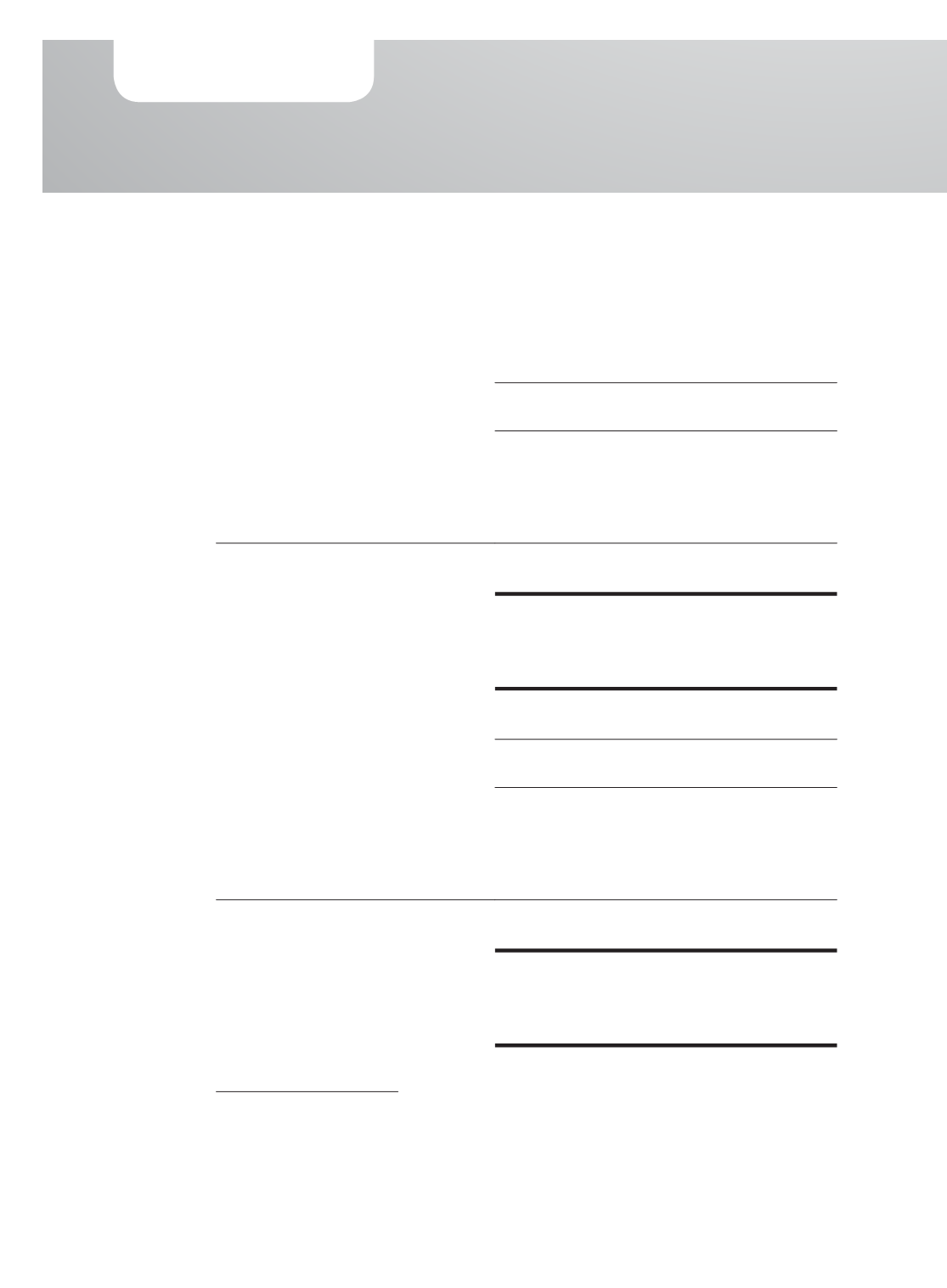

33.

FAIR VALUE OF ASSETS AND LIABILITIES (CONTINUED)

(b)

Assets and liabilities not carried at fair value but for which fair value is disclosed

The following table shows an analysis of the Group’s assets and liabilities not measured at

fair value at 31 December 2015 and 2014 but for which fair value is disclosed:

Group

2015

$’000

Quoted prices

in active

markets for

identical assets

Significant

unobservable

inputs

Carrying

amount

(Level 1)

(Level 3)

Assets

Investment in associate (BRC)

29,923

–

49,028

Liabilities

Obligations under finance leases

–

607

624

Bank borrowings

–

6,556

6,817

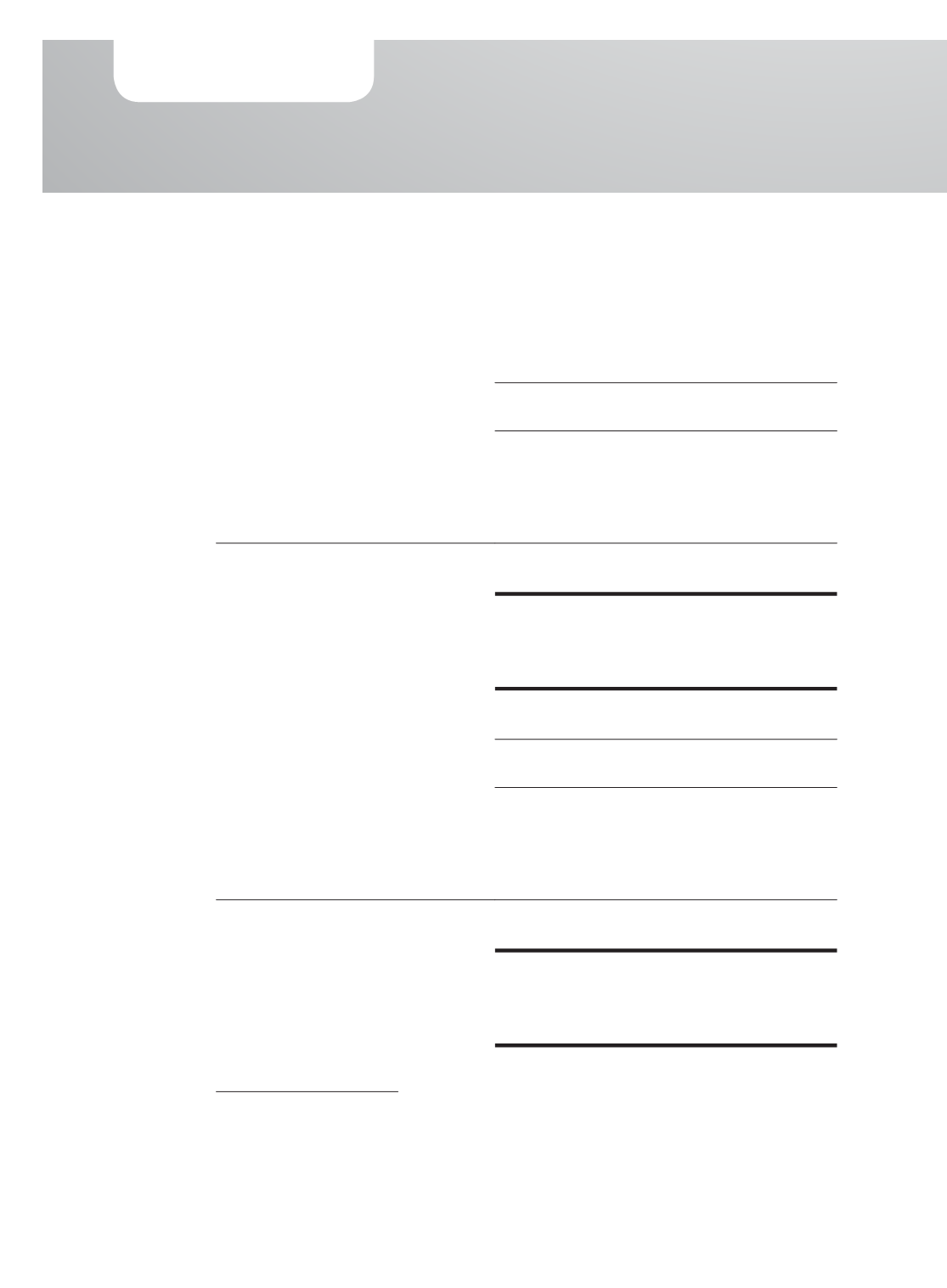

Group

2014

$’000

Quoted prices

in active

markets for

identical assets

Significant

unobservable

inputs

Carrying

amount

(Level 1)

(Level 3)

Assets

Investment in associate (BRC)

36,667

–

49,428

Liabilities

Obligations under finance leases

–

63

67

Bank borrowings

–

12,229

12,712

Determination of fair value

Obligations under finance leases: Fair value is estimated by discounting expected future cash

flows at market incremental lending rate for similar types of leasing arrangements at the

balance sheet date.

116

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015