34.

FINANCIAL RISK MANAGEMENT (CONTINUED)

(b)

Liquidity risk (continued)

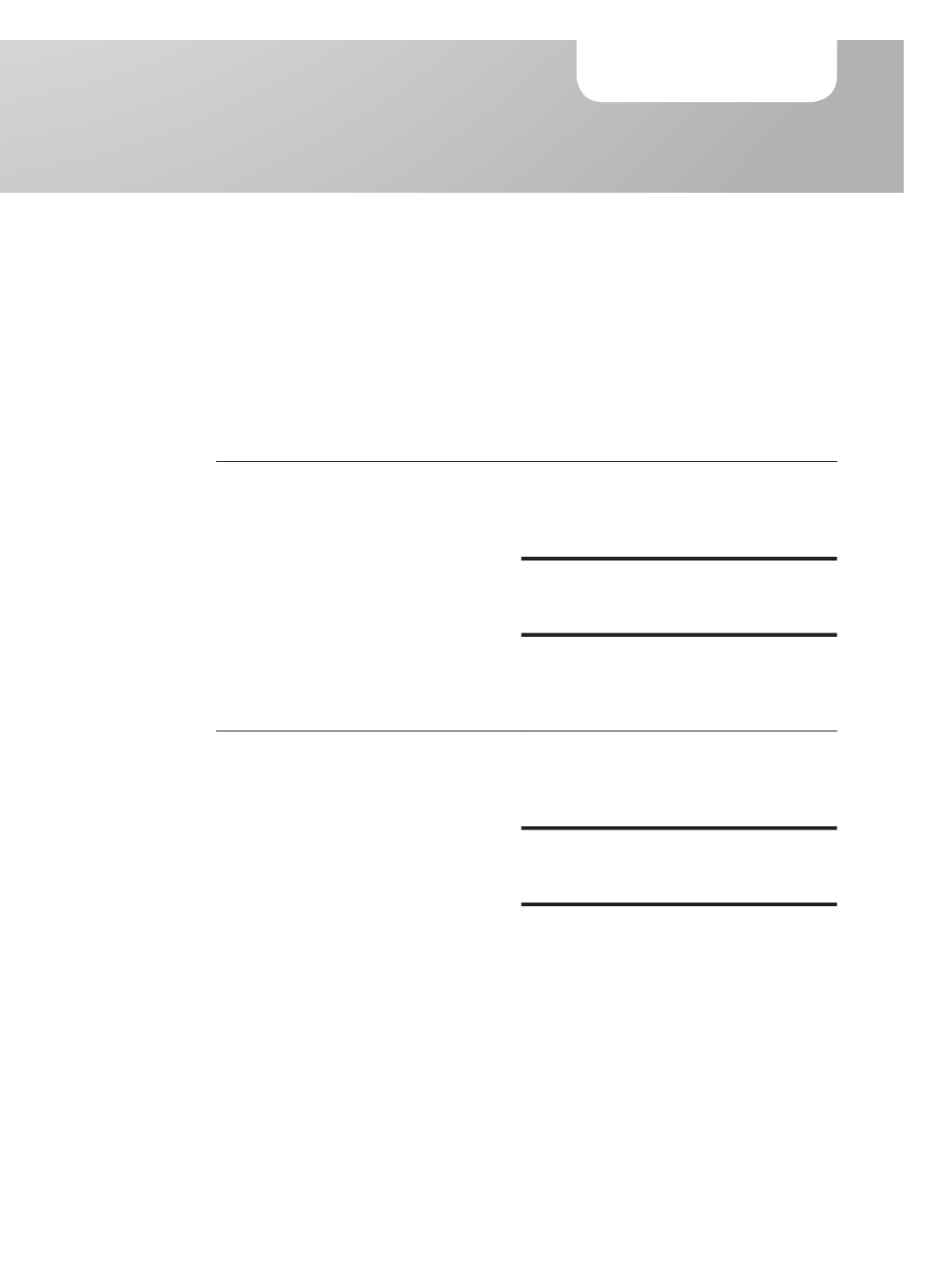

The table below shows the contractual expiry by maturity of the Group and Company’s

contingent liabilities and commitments. The maximum amount of the financial guarantee

contracts are allocated to the earliest period in which the guarantee could be called.

Within

one year

Two to

five years

Total

$’000

$’000

$’000

Group

As at 31 December 2015

Financial guarantees

–

–

–

As at 31 December 2014

Financial guarantees

1,768

–

1,768

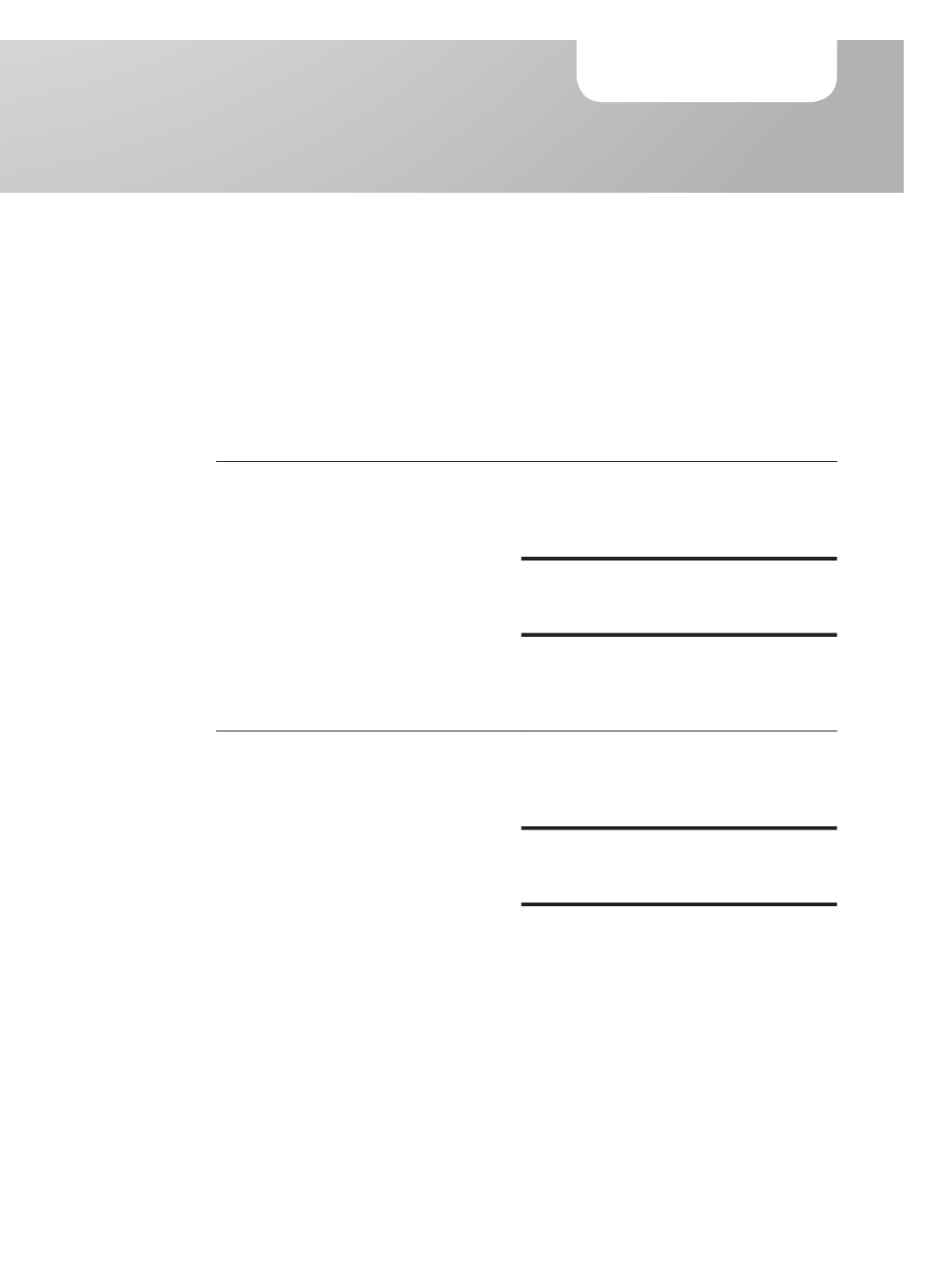

Within

one year

Two to

five years

Total

$’000

$’000

$’000

Company

As at 31 December 2015

Financial guarantees

–

–

–

As at 31 December 2014

Financial guarantees

1,768

–

1,768

(c)

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of the Group’s and the

Company’s financial instruments will fluctuate because of changes in market interest rates.

The Group’s and the Company’s exposure to interest rate risk arises primarily from finance

lease payables and bank borrowings. All of the Group’s and the Company’s financial assets

and liabilities at floating rates are contractually re-priced at intervals of less than 3 months

from the balance sheet date.

The Group’s and Company’s exposure to interest rate risk relate primarily to interest-bearing

fixed deposits and debt obligations with financial institutions.

123

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015