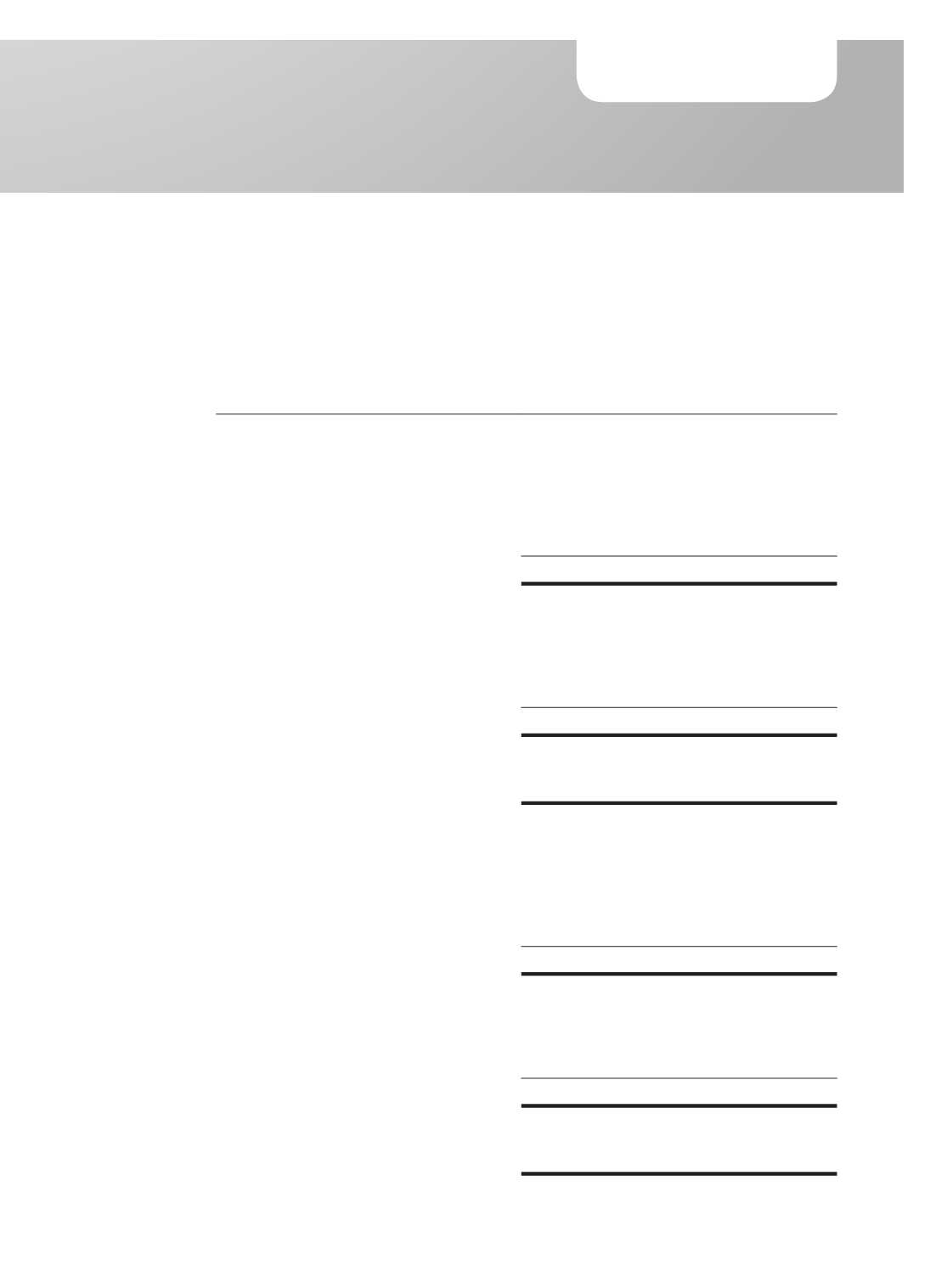

34.

FINANCIAL RISK MANAGEMENT (CONTINUED)

(b)

Liquidity risk (continued)

The following are the contractual maturities of financial assets and liabilities of the Group and

Company at balance sheet date based on contractual undiscounted payments:

Within

one year

Two to

five years

Total

$’000

$’000

$’000

Group

As at 31 December 2015

Financial assets:

Trade and other receivables

31,889

–

31,889

Cash and cash equivalents

50,514

–

50,514

Total undiscounted financial assets

82,403

–

82,403

Financial liabilities:

Derivative financial instruments

59

–

59

Trade and other payables

8,453

–

8,453

Finance lease payables

257

395

652

Bank borrowings

4,291

2,696

6,987

Total undiscounted financial liabilities

13,060

3,091

16,151

Total net undiscounted financial assets/

(liabilities)

69,343

(3,091)

66,252

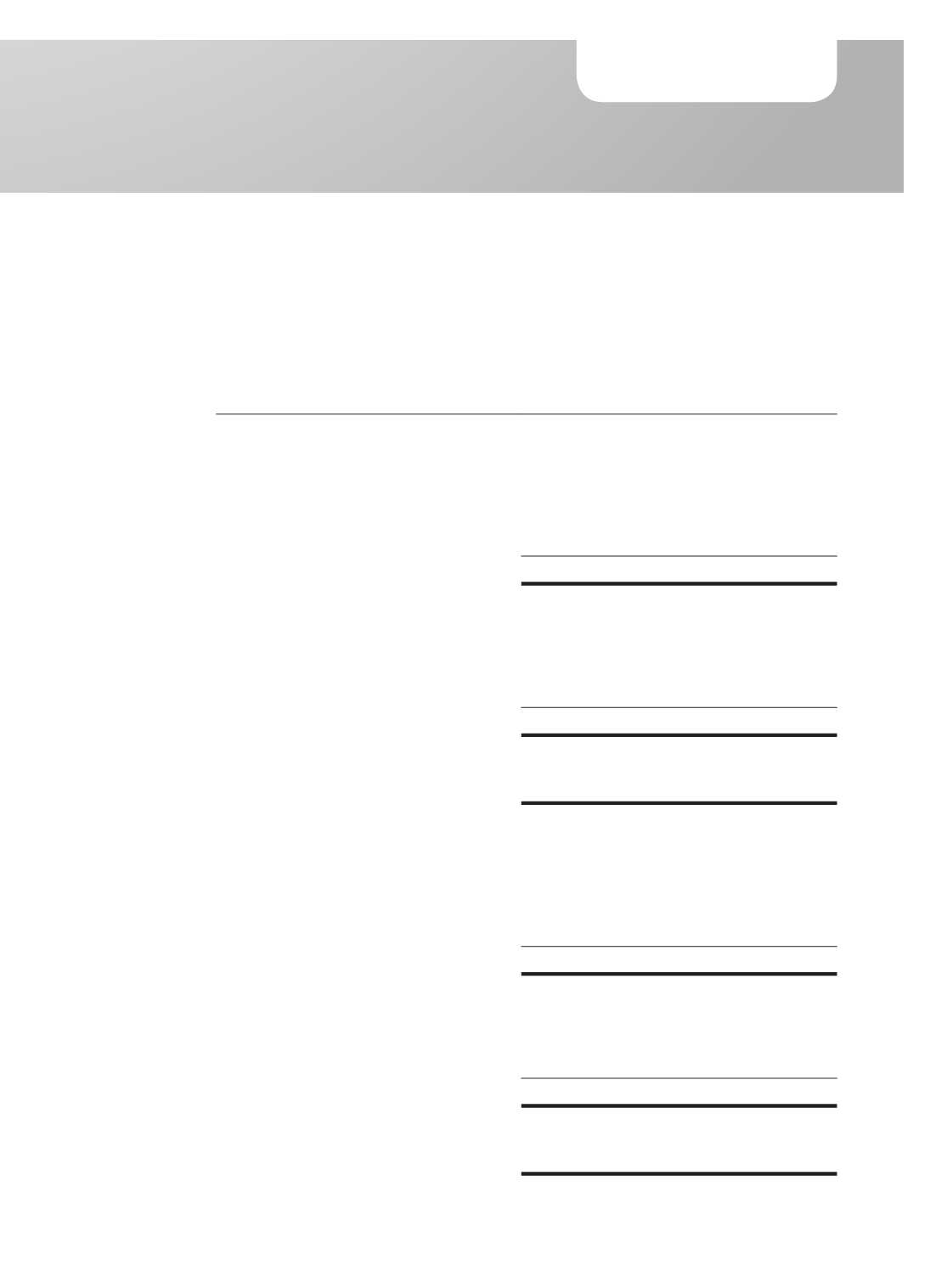

As at 31 December 2014

Financial assets:

Investment held for trading

110

–

110

Trade and other receivables

35,547

–

35,547

Cash and cash equivalents

52,661

–

52,661

Total undiscounted financial assets

88,318

–

88,318

Financial liabilities:

Trade and other payables

24,350

–

24,350

Finance lease payables

46

24

70

Bank borrowings

5,990

7,110

13,100

Total undiscounted financial liabilities

30,386

7,134

37,520

Total net undiscounted financial assets/

(liabilities)

57,932

(7,134)

50,798

121

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015