33.

FAIR VALUE OF ASSETS AND LIABILITIES (CONTINUED)

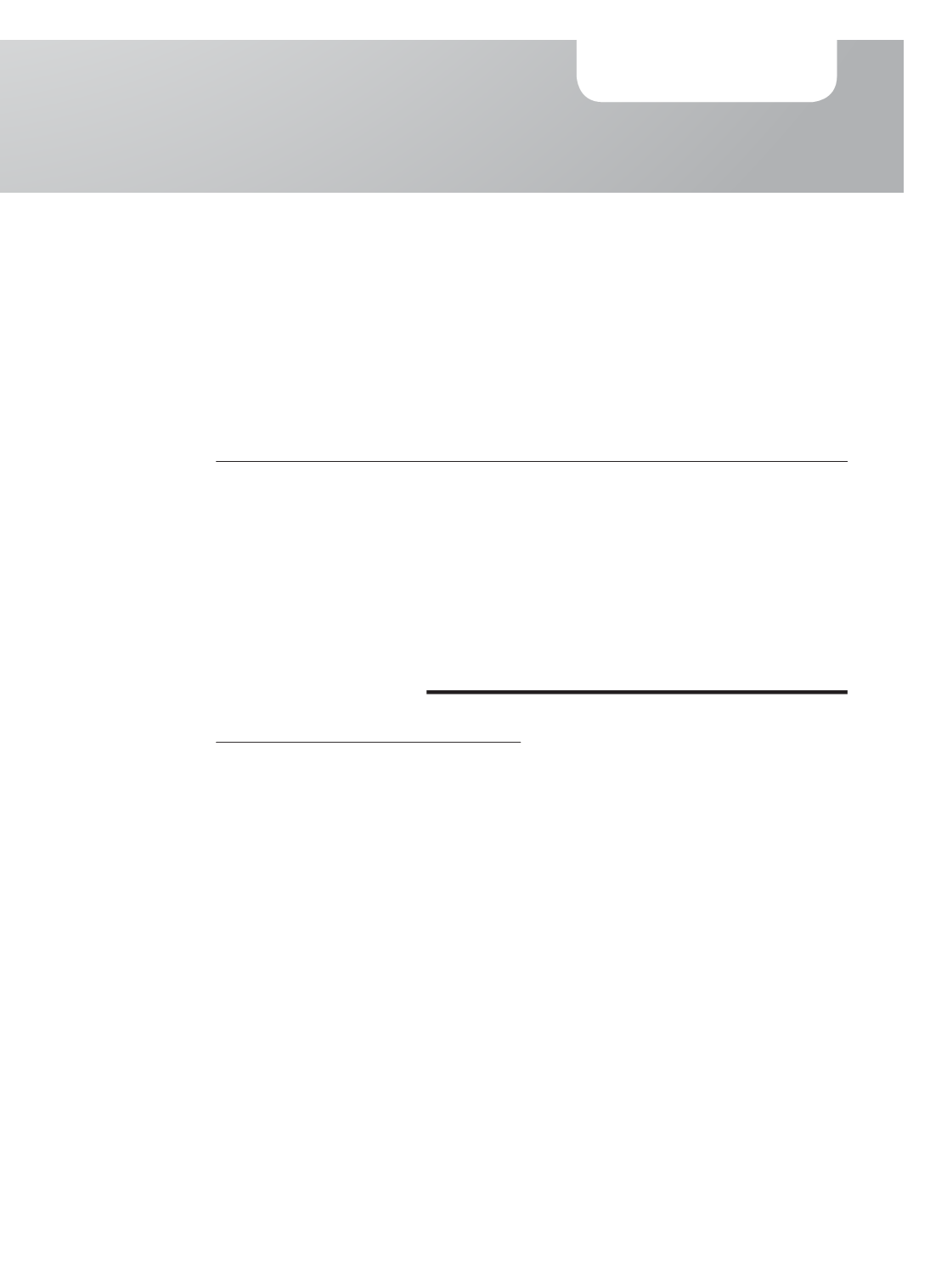

(c)

Fair value of financial instruments by classes that are not carried at fair value and

whose carrying amounts are not reasonable approximation of fair value

The fair value of financial assets and liabilities by classes that are not carried at fair value

and whose carrying amounts are not reasonable approximation of fair value are as follows:

Carrying amount

Fair value

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Group

Financial Assets:

Investment in associate

(POS-SEA Pte Ltd)

475

60

*

*

Financial liabilities:

Obligations under finance

leases

624

67

607

63

Bank borrowings

6,817

12,712

6,556

12,229

*

Investment in equity securities carried at cost

Fair value information has not been disclosed for the Group’s investment in equity securities

that are carried at cost because fair value cannot be measured reliably. These equity securities

represent ordinary shares in a company that is not quoted on any market and does not

have any comparable industry peer that is listed. In addition, the variability in the range of

reasonable fair value estimates derived from valuation techniques is significant. The Group

does not intend to dispose of this investment in the foreseeable future.

34.

FINANCIAL RISK MANAGEMENT

The Group and the Company are exposed to financial risks arising from its operations and the use of

financial instruments. The key financial risks include credit risk, liquidity risk, interest rate risk, foreign

currency risk and market price risk. The Board of Directors reviews and agrees policies and procedures

for the management of these risks, which are executed by the Financial Controller.

117

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015