34.

FINANCIAL RISK MANAGEMENT (CONTINUED)

(d)

Foreign currency risk (continued)

Sensitivity analysis for foreign currency risk (continued)

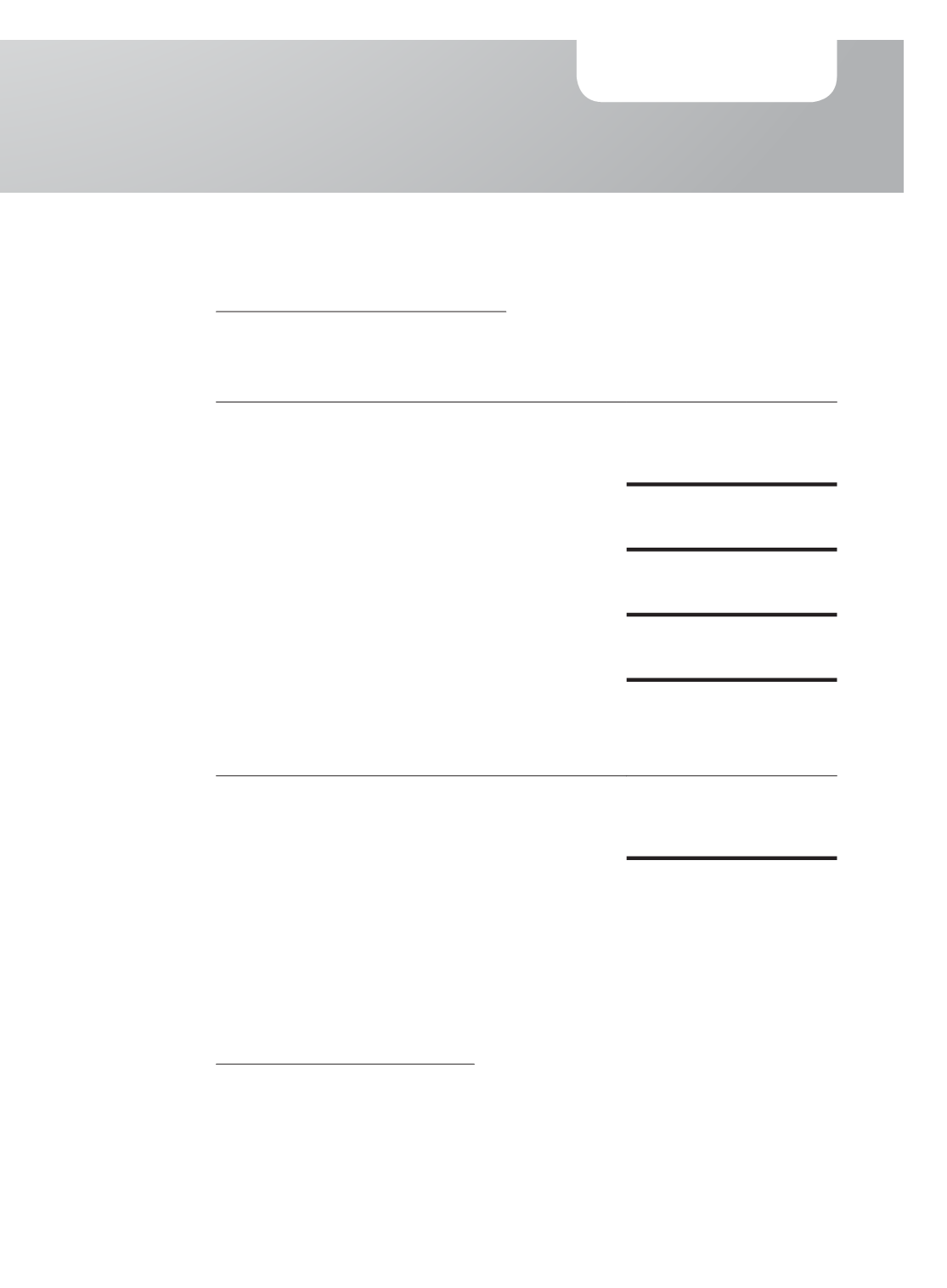

Increase/(decrease)

Profit before tax

2015

2014

$’000

$’000

Group

USD/SGD – strengthened 2% (2014: 2%)

468

315

– weakened 2% (2014: 2%)

(468)

(315)

SGD/MYR – strengthened 2% (2014: 2%)

1

119

– weakened 2% (2014: 2%)

(1)

(119)

USD/MYR – strengthened 2% (2014: 2%)

–

98

– weakened 2% (2014: 2%)

–

(98)

MYR/SGD – strengthened 2% (2014: 2%)

–

29

– weakened 2% (2014: 2%)

–

(29)

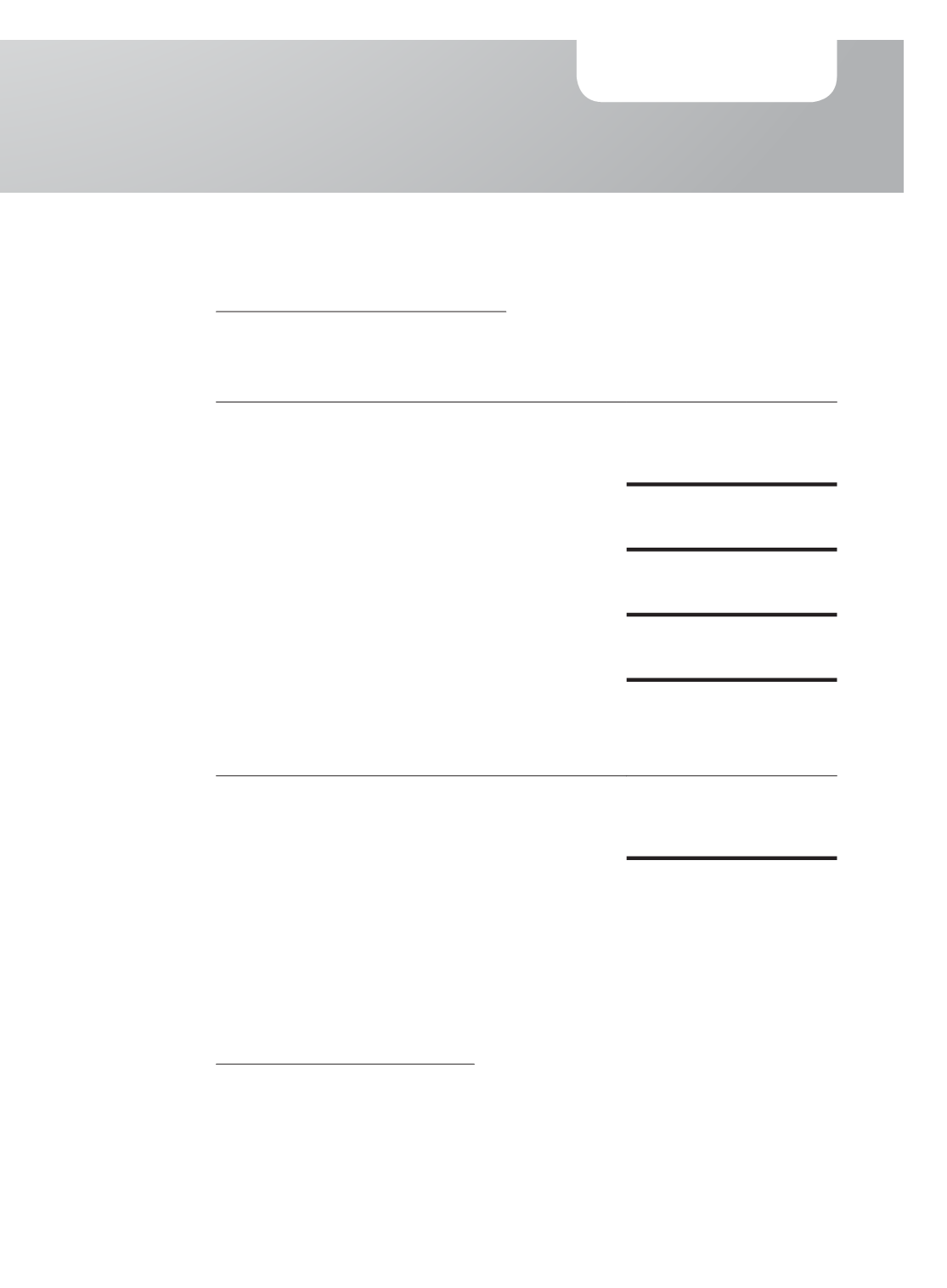

Increase/(decrease)

Profit before tax

2015

2014

$’000

$’000

Company

USD/SGD – strengthened 2% (2014: 2%)

442

283

– weakened 2% (2014: 2%)

(442)

(283)

(e)

Market price risk

Market price risk is the risk that fair value or future cash flows of the Group’s financial

instruments will fluctuate because of changes in market prices (other than interest or exchange

rates). The Group is exposed to equity price risk arising from its investment in quoted equity

instruments. These instruments are quoted on the SGX-ST in Singapore and are classified as

held for trading.

Sensitivity analysis for equity price risk

At 31 December 2015, the Group did not hold such financial instruments and no exposure to

market price risk. At 31 December 2014, if the STI had been 2% higher/lower with all other

variables held constant, this would have given rise to higher/lower fair value gains in held

for trading equity instruments and the Group’s profit before tax would have been $2,200

higher/lower.

125

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015