34.

FINANCIAL RISK MANAGEMENT (CONTINUED)

(a)

Credit risk (continued)

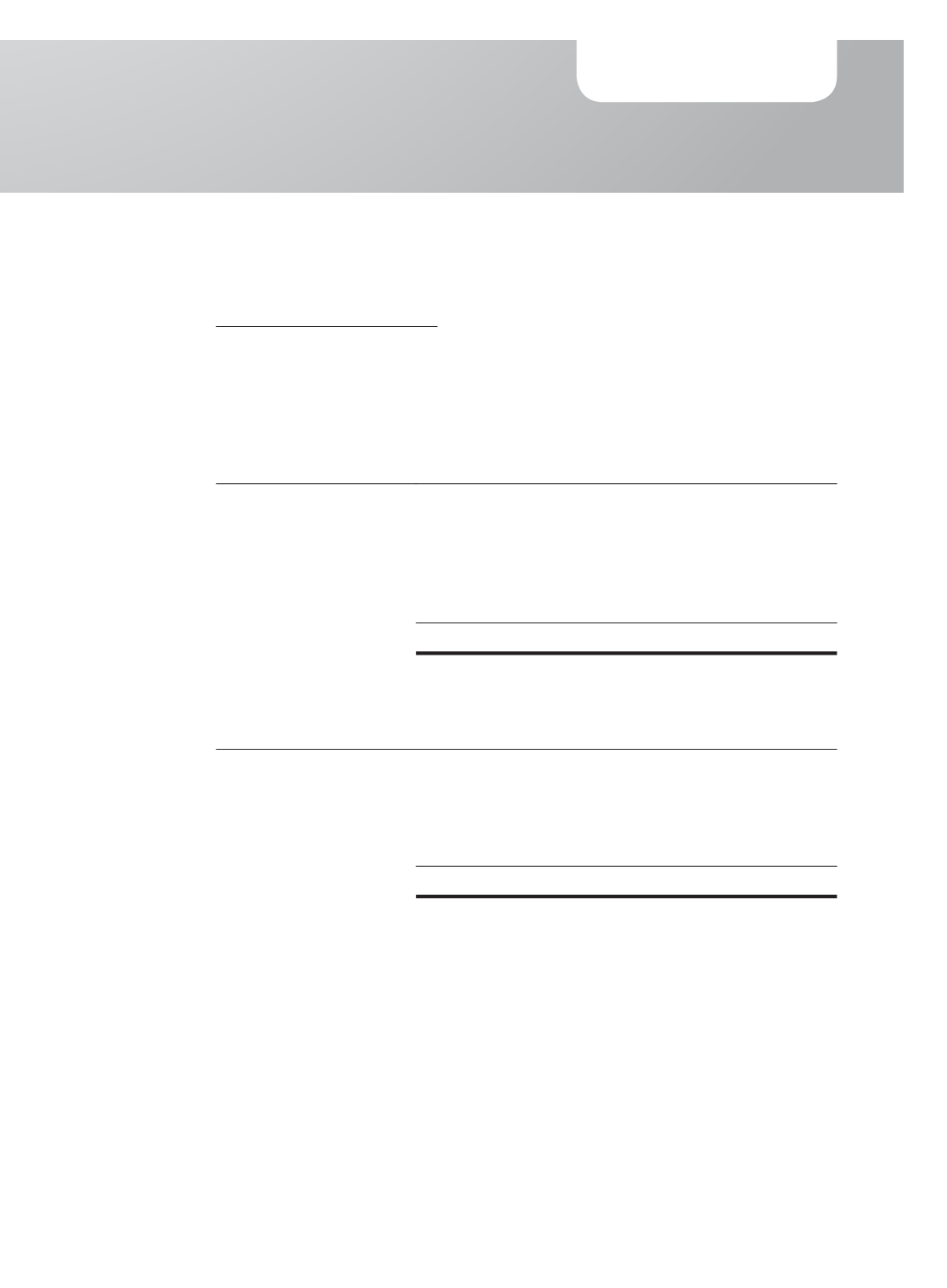

Credit risk concentration profiles

The Group’s and the Company’s trade receivables concentration profiles by geographical

areas and industry sectors as at balance sheet date are as follows:

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

By country:

– Myanmar

20,667

9,135

20,667

9,135

– Singapore

8,503

17,307

9,094

19,962

– Malaysia

46

6,347

46

4,518

– Indonesia

411

440

411

440

– Others

126

216

126

216

29,753

33,445

30,344

34,271

Group

Company

2015

2014

2015

2014

$’000

$’000

$’000

$’000

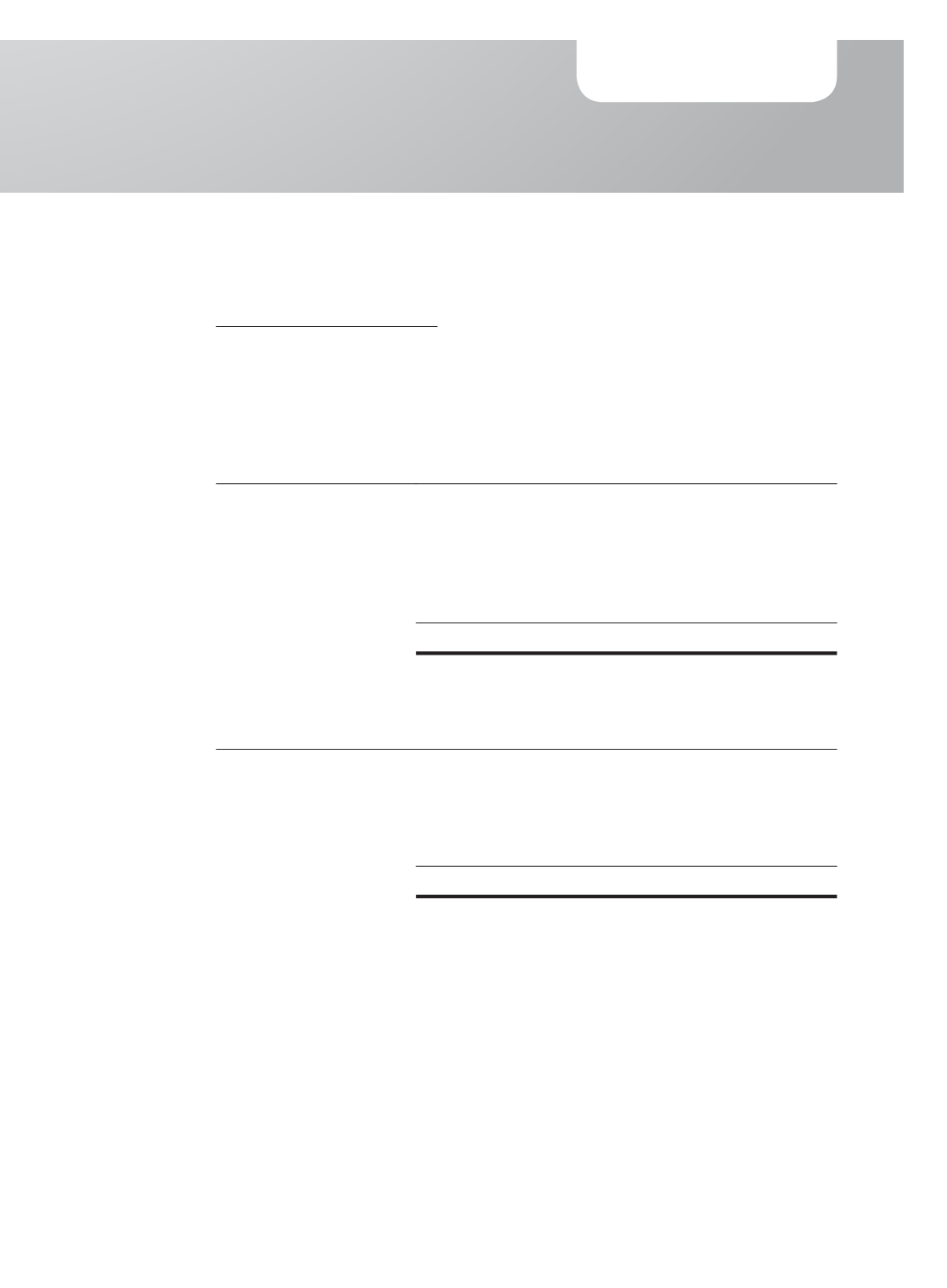

By industry sectors:

– Trading

24,900

22,996

28,945

21,152

– Construction

3,864

7,226

410

9,921

– Shipping

–

2,129

–

2,129

– Others

989

1,094

989

1,069

29,753

33,445

30,344

34,271

At the end of the reporting year/period, approximately:

–

91% (2014: 31%) of the Group’s trade receivables were due from 3 (2014: 3) major

customers who are located in Singapore, Indonesia and Myanmar (2014: Singapore,

Indonesia and Myanmar).

–

0.10% (2014: 0.23%) of the Group’s trade receivables were due from related parties.

119

HG METAL MANUFACTURING LIMITED

ANNUAL REPORT 2015

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31 December 2015